|

|

|

|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Does your energy firm owe you £100s? It's the PERFECT time to check if your Direct Debit's too in-credit Energy firms are sitting on over £3 billion of our cash - around £180 per household. And a decent whack of that should be back in people's pockets. This can be tricky to do as firms throw up lots of reasons to hold on to our cash, one of which is timing, but check right now, and you can defeat the timing excuse - making it all a lot easier. And while you're at it, why not use our restarted Cheap Energy Club to ensure you're on the cheapest deal possible too...

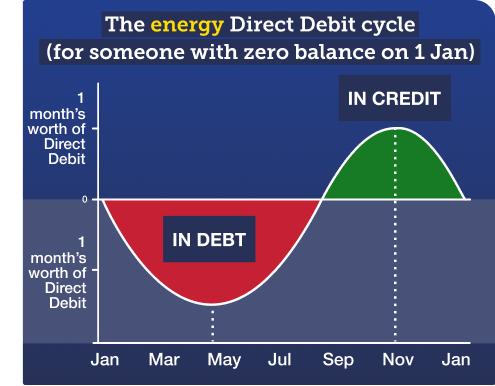

Monthly Direct Debits aim to smooth out seasonal usage, so you pay the same year-round. That means you build up credit in summer, and use it, or build up debt, in winter. Crucially, now - early May - is the bottom of the cycle, so you shouldn't have much credit. So if you've done an up-to-date meter reading (or your smart meter has), your bill is up to date, and your Direct Debit is the right level (see our Direct Debit Calc), now is the perfect time to see if you've too much energy credit. More than a month's worth right now is certainly a lot, so ask for it back (far more on that in Martin's blog), but to encourage you, Andy emailed Martin in March: "I went to my energy supplier today to input my gas/elec readings as per your piece on breakfast TV, and was shocked to see I was £2,016 IN CREDIT. Many thanks." 2. The cheapest fixes - lock in, save money, get peace of mind. Fixes are back, and if you're in one of the 90% of homes (not N. Ireland) on a Price Cap tariff, then you can pay less and get certainty over what you'll pay. Our Cheap Energy Club comparison also includes a unique way to demonstrate to those on the Price Cap a bespoke prediction of its costs over the next year, so you can compare that with fixing (though our comparison's currently only optimised for dual-fuel price-capped monthly Direct Debit users - we're working on improving that).

4. Ends 4pm Thu. On prepay? You may be able to fix too. Prepay fixes are rarer than Martin making an impulse purchase, yet EDF's Essentials 1yr May25 fix is available to new and existing customers including those already on smart prepay meters (but we can't switch you if it's prepay, so sadly no cashback in that case). 5. Struggling to pay your bills? See our full What to do if you're struggling to pay energy bills guide. | |||||||||||||||||||||

| 1p Walkers, 45p Heinz soup & more - via 10% off code for already reduced, past 'best befores'. MSE Blagged. Super cheap, 'beyond best-before' goods, but still edible. Min £22.50 spend and £3+ delivery. Approved Food New. Top savings if you've £10,000+, paying 5% 'easy access' plus £50. Savings marketplace Raisin lets you save and move money via different banks after filling in just one form. Newbies to it who open Paragon's 5% AER* easy-access savings via it (link takes you there) can again use code MSMG5024 to get £50 cashback after 6mths as long as they've kept £10,000+ in it (so it is easy access, but cashback needs a min balance). Next top equivalent is Kent Reliance's 4.96% AER (min £1,000). Full info: Raisin help. And for far more options and choice, see Top savings and Top 5.17% cash ISAs. Tricks to bag brand-new clothes at second-hand prices, eg, £197 bodysuit £6, £35 Asos dress £5. See how in MSE Olivia's Buy new, second-hand? blog. New. Top 22mth 0% spending card - borrow interest-free for nearly two years. If you need to borrow (never do it willy-nilly filling budget gaps) then do it interest-free. Just ensure it's for a planned, one-off purchase and you can budget to repay it within the 0% time. Top card: The new Barclaycard up to 22mths 0% charges no interest on spending for 22mths if you're pre-approved via our eligibility calc (link goes there) - if not, you may be offered a shorter 0%. In which case, if you've decent odds of getting NatWest's 19mths 0%, consider that instead, as all accepted get 19mths. Golden rules: 1) Always pay at least the min monthly payment. 2) Never withdraw cash. 3) Clear debt before the 0% ends or you'll pay 24.9% rep APR. Full help in 0% spending cards. Want to cut EXISTING debt costs? These cards aren't for you, do a balance transfer. How kids can earn a Blue Peter badge to get FREE entry to 200+ attractions. Find out how to earn one in time for the summer holidays, and how it compares with other deals. Ends Thu. 50GB Sim just '£5.50/mth'. This iD Mobile Sim (uses Three's signal) is £8/mth, but till 11.59pm on Thursday (though these deals do sometimes get extended), you can CLAIM (don't forget) a £30 Amazon or Currys voucher. Factor that in and it's equivalent to £5.50/mth over the 12mth contract. Want different data/network? Use Cheap Mobile Finder. 'I got £1,040 in compensation for an old flight delay.' Our success of the week comes from Leo: "I didn't realise I could go back up to six years to claim flight delay compensation. I was delayed long-haul from Manchester to Brisbane, Australia, in January 2020, arriving 11 hours late. I followed your guidance and claimed direct with Singapore Airlines and three weeks later £1,040 was paid into my account for me and my wife. Brilliant result, thanks." If we've helped you save (on this, or owt else), please send us your successes. Martin's new podcast: Finally, energy fixes that save you cash - how to decide if you should | Your grandparents' financial wisdom | Mental health & benefits | HIGNFY news. Plus more in the new The Martin Lewis Podcast. Listen via BBC Sounds | Spotify | Apple or wherever you like to get your Martin fix. |

| As cat owners are warned about microchipping...

As for pet insurance itself, costs are rising, so it's not surprising the Competition and Markets Authority has launched a formal investigation into vet bills. Our full Cheap pet insurance guide takes you through it step by step, but in brief...

|

| NHS, care or emergency worker? New 20% off Pizza Express, Frankie & Benny's, Harvester plus more discounts. See all 40 NHS discounts. 50% off Northern Rail advance fares. For Northern app newbies - applies to Northern network only. All aboard Martin: We can't ignore the impact of money issues on mental health. Here's what we're trying to do about it. Tesco Clubcard holder? Check if you can earn up to £50 with new limited offer. You need to opt in and be one of initial 3m users selected. See 'Clubcard Challenges'. Related: Spend/extend Clubcard vouchers as £17m due to expire. FREE National Cycling Show Birmingham tix (normally £18). 15 to 16 June - 7,500 available. Wheel good fun Reminder. Santander to slash rate on its 5.2% easy-access saver. Many of you grabbed this account in September, expecting the rate to last a year - but it's being cut to 4.2% this month. Ditch and switch? Subway customer? You've ONE WEEK to use or lose your loyalty points. See Subway Rewards. |

| AT A GLANCE BEST BUYS

|

| THIS WEEK'S POLL Do you own a cat and is it microchipped? As we talk about in our pet insurance note above, from Monday 10 June, all cats aged 20+ weeks must be microchipped and have their details registered on a database - with owners failing to do so potentially being fined £500. So we want to know: do you own a cat, and is it already microchipped? Vote in this week's poll. Over half of MoneySavers switched to a new energy tariff in the past six months. Last week, we asked whether you switched or fixed your energy in the past six months. Just under 5,000 of you responded, with 55% changing their tariff. Of those, almost two-thirds (63%) switched to a fixed tariff with their existing supplier - while one in four (26%) switched to a fixed or variable tariff with a new supplier. See full energy poll results. |

| MONEY MORAL DILEMMA Should we cease contact with our daughter's ex-husband who owes us money? Over several years, we lent our daughter's now ex-husband £20,000 for various business ventures, all of which failed. They got divorced this year but we've maintained contact to recoup our money. He's making monthly repayments and has, to date, paid back £6,000. However, our daughter has taken legal action to stop him from contacting her, and has told us she doesn't want us talking to him as it means he potentially has access to her. Should we do as she wants and risk losing the outstanding £14,000? Enter the Money Moral Maze: Should we cease contact with our daughter's ex? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

| | |

|---|

| MARTIN'S APPEARANCES (TUE 7 MAY ONWARDS) Wed 8 May - Co-presenting Good Morning Britain, ITV1, 6am |

| AI, TRACING FAMILY TREES AND PET TORTOISE CARE - WHAT WILL YOU DO WHEN YOU'RE RETIRED? That's all for this week, but before we go... at MSE we often talk about getting your finances in order for retirement, but what will you actually do when it arrives? Forumites on our pensions board have been sharing their stories and ambitions. One retiree took up jigsaws before deciding AI is the future and embarking on a PhD instead. Another has spent 22 years tracing their family history back to the 1700s, adding 5,300 people to their family tree. Others find satisfaction in part-time work, with one MoneySaver using a food delivery job as a way of meeting people. For one, semi-retirement has been completely different from what they expected - with fulfilment coming from low-cost community activities rather than expensive globe-trotting. And caring responsibilities are a reality for many - with one poster saying that even looking after two pet tortoises takes a surprising amount of time. Share your retirement hopes, dreams and experiences in our What to do with all your time? forum thread. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email paragonbank.co.uk, moneysupermarket.com, comparethemarket.com, confused.com, petplan.co.uk, waggel.co.uk, napo.pet, agriapet.co.uk, animalfriends.co.uk, exotic-pets.co.uk, petplanequine.co.uk, tescobank.com, barclaycard.co.uk, natwest.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment