|

|

| ||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Cut mobile phone insurance by £100/yr per person Many pay over the odds. Switch to cheap standalone policies or 'self-insure' to save Are you a loser? If like many of us (Martin certainly admits to being a loser), you've a habit of misplacing, dropping or otherwise damaging that expensive handset, then having cover is worth it. In our modern world, many feel their lives cut in half without a phone. Our Cheap mobile insurance guide has full info, but here's a quick briefing...

|

| Ends today (Wed) 11.59pm. Rare Homebase 15% off code. Online and in store. See Homebase sale. 'Free' National Trust family day pass (normally £30ish). Via papers. Excludes Scot & bank hols. Family days out New. Top 0% balance transfer card, a DEFINITE 27mths 0% with a lower fee. You can shift existing card debt(s) to Virgin Money's 27mth 0% card and, last Thu, it cut the one-off fee to 3% making it the cheapest long card - better still, all accepted definitely get the full 0% period. Barclaycard offers 28mths 0%, but it's an 'up to' card so not all accepted get the full 0% length and its fee's a higher 3.45%. Links go via our eligibility calculator so you can see if you'll likely get them, but also see full help and options in top balance transfers. Golden rules: Repay at least the monthly minimum & clear the card before the 0% ends or they jump to 24.9% rep APR. May the fourth be with you - FREE Star Wars Lego. At Lego & Smyths stores this weekend, limited stock. Free Lego Samsung S24 '£30/mth' for 500GB. Newbies to iD Mobile (uses Three's signal) can get the S24 (128GB), the latest model Samsung, on a 24mth contract with 500GB of data & unlimited calls/texts via Mobiles.co.uk. It's £99 upfront but you get £10 cashback (use code CASH10), then pay £25/mth (rises by inflation + 3.9% in Apr 2025). So it could be around £710 over the 2yrs and the handset alone is £799 direct from Samsung. The retailer's responsible for the handset, iD Mobile for the contract. Find cheap handsets/Sims: Cheap Mobile Finder. 24 Oriental lily bulbs £9 delivered. MSE Blagged. 12,000 available, excluding N. Ire/parts of Scot. Thompson & Morgan Ends Thu 11.59pm. 132Mb Virgin broadband '£20.95/mth'. MSE Blagged. Switchers in 60% of UK homes can get this Virgin 132Mb broadband & line deal for £26.50/mth plus an automatic £100 bill credit, equivalent to £20.95/mth over the 18mth contract. Full comparison: See MSE Broadband comparison. BMW or Ford diesel driver? Decide now whether to join emissions lawsuits. Firms have set May deadlines for new claims against these brands. See diesel claim pros & cons. Martin's new podcast: Pay over £8/mth for your mobile or £30/mth for broadband? STOP | Barclaycard customer warning | Zara trick. And more in the new The Martin Lewis Podcast. Listen via BBC Sounds | Spotify | Apple or wherever you like to get your Martin fix. |

| |

|---|

|

PS: Earn £200/day counting votes in elections? Councils need help counting votes and staffing polling booths for general, local & mayoral elections - it's a great opportunity to help make democracy work while earning some extra cash. For example, we saw counting assistant jobs at £200/day. While councils we spoke to were fully staffed for the 2 May local elections, many were still adding to reserve lists. Plus, it'll get you on the database for the next general election. |

| STOP PRESS. Finally, Govt launches 'buy extra national insurance years' online tool. Some people can now use the new Govt tool to buy extra years. This is complex: It can be very lucrative for many, and a waste for some, so this is just a holding note, we'll bring you a full update in next week's email. Meanwhile, read our buy state pension years? guide. £35 skincare set from 'I Am Proud' (£100 bought separately). MSE Blagged. The much-hyped brand is from the owners of Ciaté and Lottie London, and it's offering an 8-piece set including its vitamin C serum (mimicking £80 Sunday Riley's), facewash, toner & more beauty dupes. I Am Proud "I took on the 'ADHD tax' and saved £312/yr thanks to your mobile haggling tips." Our success of the week comes from Penny, who emailed Martin: "I'm a big fan of yours. I have ADHD, you've probably heard of the 'ADHD tax' where we can waste money by not sorting our finances. My mobile bill had risen to £40/mth and I barely phone anyone. I kept getting images of you looking at me disapprovingly, and finally now it's down to £14/mth. A huge saving for me thanks to your mobile haggling tips & all the amazing people at MSE." If we've helped you save (on this, or owt else), please send us your successes. Standing charges, broken smart meters & more: Sec of State for Energy responds after Martin raised critical issues. See her full written response. Get Spotify Premium FREE for three months (if you're a newbie). Listen ad-free, on demand & offline. Cancel anytime - £11.99/mth after if you don't. Free Spotify. Related: Spotify hiking prices by up to £24/yr. New. £5 off all train tickets via Uber - can you find it? The transport app's offering a discount on fares to 'select users' who haven't booked rail travel with it before. Track down £5 off trains Live in Scotland? FREE Open University courses (normally costing up to £800). Apply for a microcredential course (undergrad or postgrad). 500 places available. Open University Scotland. Related: We've also partnered with the Open University to offer a free UK-wide personal finance course - see MSE's Academy of Money. |

| AT A GLANCE BEST BUYS

|

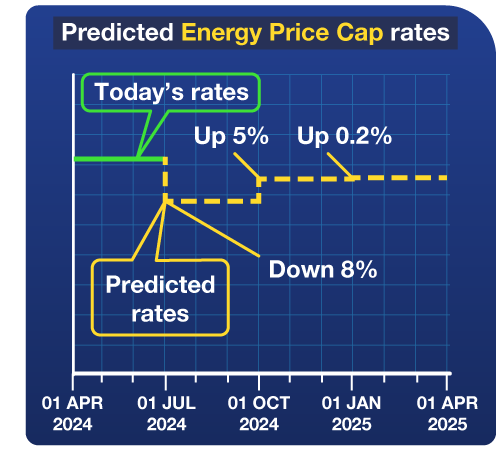

| THIS WEEK'S POLL Have you switched or fixed your energy in the past six months? There has been a small spark of recovery in energy switching in recent weeks, as providers have dropped the prices of their fixed deals. With that in mind, this week we want to know whether you've switched or fixed your energy bills in the past six months and why (or why not)? Vote in this week's poll. Most MoneySavers with credit card debt have it all at 0% interest. Last week, we asked how much you owe on credit cards. Of the more than 9,600 people who responded, around half pay off their card IN FULL each month (Martin would be proud). Of those who did have debt, about three in five said it was all at 0% interest. See the full credit card poll results. |

| |

|---|

| MONEY MORAL DILEMMA Should my husband stop lending money to his parents? My husband has lent a substantial amount of money - in the thousands - to his parents on a few occasions now. They always say it's to pay bills, so he feels obliged. To be fair to them, they do always pay us back eventually, but not before going out to coffee shops and restaurants and constantly buying things they don't need. Should he keep lending them money, or should he tell them they need to stand on their own two (four?) feet and stop spending so much? Enter the Money Moral Maze: Should my husband stop lending money to his parents? | Suggest a Money Moral Dilemma (MMD) | View past MMDs |

| | |

|---|

| MARTIN'S APPEARANCES (TUE 30 APR ONWARDS) Wed 1 May - Ask Martin Lewis, BBC Radio 5 Live, 1pm |

| TURN LIGHTS OFF, PUT A JUMPER ON AND PUT T'WOOD INT' 'OLE - WHAT'S YOUR NO. 1 HOUSEHOLD RULE? That's all for this week, but before we go... after a recent survey showed 'switch the lights off when you leave' is the most popular household 'rule', we asked what the rules in your household were. Many centred on keeping energy use down, with turning off lights, putting a jumper on rather than the heating if you're cold, leaving the oven door open after use to heat the home and not boiling more water than needed in the kettle all popular. As was closing the door when leaving a room, and its northern equivalent "put t'wood int' 'ole". The strangest rule? "Do not drunkenly use Sellotape to attach a Toblerone to the next door neighbour's cat, so you can play 'My Little Stegosaurus'." We're intrigued, but have decided we really don't want to know! Tell us your number one household rule in our Facebook, Twitter and Instagram conversations. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email insurance2go.co.uk, mobilephoneinsurancedirect.com, loveitcoverit.com, switchedoninsurance.com, nationwide.co.uk, lloydsbank.com, santander.co.uk, barclaycard.co.uk, natwest.com Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment