|

|

| |||||||||||||||||||||||||||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

| Martin: It's #DDday. Prepare for a shock! Take my 5min Direct Debit (standing order & recurring payment) challenge to see if you're WASTING £100s It isn't rocket science, but it is important financial housekeeping. Regular payments are PASSIVE transactions, money auto-paid, dripping from our pockets without our conscious action. While they're often a valuable tool to ensure crucial bills are paid, millions who don't check them often enough are likely wasting £100s on products and services they no longer want or use - or worse - that are completely pointless... So let's make today Direct Debit Day. Check now what you're paying for (& pls report surprise finds on social media using #DDday) As for what I mean by pointless, here are two people who have previously discovered that: "For the last four years, I'd paid £12 a month (£144/yr) for extended warranty on a laptop I no longer had", and: "Moved two years ago, but still paying a Direct Debit to my old gym (£330/yr) & local wildlife centre (£43/yr) - both too far to visit (and I never go to the gym anyway)."

| ||||||||||||

| 740,000 car finance complaints now sent via our free tool. If you've sent one, a favour... A recap: Two weeks ago, Martin launched our free car finance mis-selling guide & tool for anyone who got a car, van, motorbike or camper van on PCP or HP between April 2007 and 28 January 2021. If that's you, jump to the guide. Submitted your complaint? We're gathering info on how different firms are dealing with it - please help by filling in this two-minute survey. Ends Thu. Cheapest 50GB mobile Sim we've seen - just '£5.50/mth'. This iD Mobile Sim (uses Three's signal) is £8/mth, but you can CLAIM (don't forget) a £30 Amazon or Currys voucher. Factor that in and it's equivalent to £5.50/mth over the 12mth contract. Want different data / network? Use Cheap Mobile Finder. News. Almost 1m in England overpaid for prescriptions in 2022/23. Are you one? Check if you can save with a prescriptions season ticket. Can't afford to clear your credit cards? QUICKLY shift debt to up to 29mths INTEREST-FREE. Top balance transfer deals have got worse recently, and that's likely to continue. So if you're paying interest, check NOW if you can shift debt to 0%. The longest card is Barclaycard's up to 29mths (one-off 3.45% fee), or if you can repay quicker, NatWest 13mths (NO fee). Links go via our eligibility calc, but see full info and other options in Top balance transfers. O2 and Virgin Media to hike broadband & mobile bills by 8.8% in April. It's the biggest price hike of the major telecoms firms. With BT, EE, Vodafone, Sky, TalkTalk, Three or others? You've 3% to 7.9% rises. Urgent. Cheap FAST broadband, 100Mb for '£24/mth' or 500Mb for '£28/mth'. Two hot fibre to the home promos available this week. Till 11.59pm on Thu, newbies can get Sky's 100Mb deal for £28/mth, but you can CLAIM a £65 prepaid Mastercard or shopping voucher, so it's equivalent to £24.39/mth over the 18mth contract. You'll need to pay a £5 upfront fee, but you get it back as bill credit. Or even faster is Vodafone's 500Mb offer, where you pay £32/mth but can CLAIM an £85 Amazon, Tesco, Sainsbury's or M&S voucher. Factored in, that's equivalent to £28.46/mth over the 24mth contract... though go quick, as the cost rises £1/mth from 10pm today (Tue). Both are available to 60% of homes (it checks when you click through). Or see other deals in our powerful broadband comparison. Summer plant bundle £14 delivered. MSE Blagged. 10,000 sets available, including bulbs, tubers & bare root plants. Excludes Northern Ireland and parts of Scotland. Thompson & Morgan Toon in for a special: Celebrating DD day, key energy updates, and up to £5k a year for 1.1m pensioners. The Martin Lewis Money Show Live, ITV 8pm tonight (Tue). Over to Martin: "It's a big live audience special in Newcastle for the last in the series. Lots of important information for you, and frankly much of the show will be 'ask me anything', so you set the agenda. Got a question? Tweet using #MartinLewis or email the team at martinlewis@itv.com. Do watch (or catch up via ITVX)." |

|

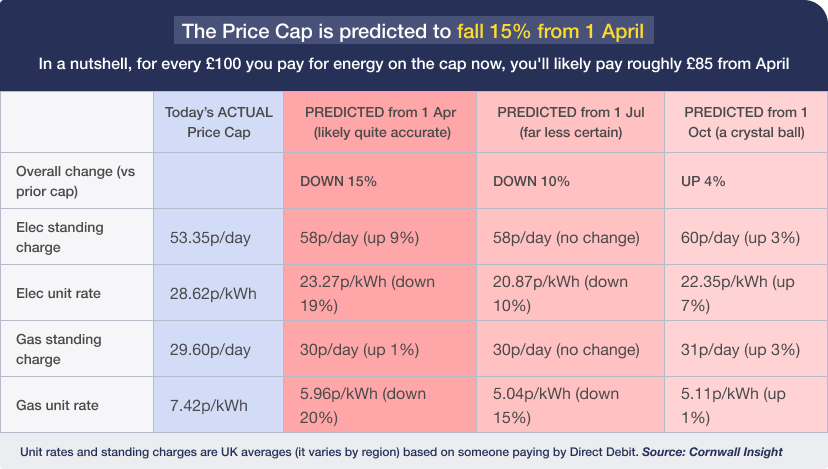

1. While overall costs are down, if nowt changes, the annual £300 standing charge 'poll tax' is predicted to rise. Martin calls the standing charge a 'poll tax', as you pay £100s just for having gas & elec meters regardless of usage. This is a moral hazard, as those on lower usage get less benefit from cutting bills. We've been campaigning hard for change, now Ofgem is reviewing it. The Cornwall Insight prediction doesn't factor in a standing charge policy change from Ofgem - we hope that happens this Friday, but aren't sure it'll be that quick. 2. You can undercut the Price Cap by 3%... E.on Next's Pledge is open to switchers & existing customers who pay by Direct Debit. It promises to remain roughly 3% below the Price Cap for a year (so £50/yr at typical use), so if the Cap drops 15% in April as predicted, so will this tariff. Therefore, as long as you're happy going to E.on, if you're going to stick on the Price Cap, you may as well move to this discounted tariff. It has £25 per fuel early-exit penalties. 3. The cheapest fixes, if you want peace of mind. The big benefit of a fix is you know exactly what you'll pay, so there won't be any shocks. Yet if the predictions are right (and it's a big if), over the next year you'll pay 17% less on average than you do right now, so you want a fix that's substantially cheaper for it to really look a winner. Most are primarily for Direct Debit customers only (and not N. Ireland).

For more info on the tariffs, including a full list of all deals available, see Should you fix your energy? 4. Substantially cheaper energy is possible with Octopus's tracker tariffs, but it's not guaranteed. Existing Octopus customers can switch to its Octopus Tracker tariff (other firms' customers can try switching to Octopus's Price Cap tariff, then once in, switch to this). Its rates change daily based on wholesale costs, which - as they're low - mean the rates have been 35% cheaper than the Price Cap on average (though of course, things can change). Alternatively, its elec-only Agile tariff's rates change half-hourly, based on wholesale prices - good for those who can shift their use out of peak hours. 5. Got an EV? Consider a dedicated tariff. Several suppliers have launched specific two-rate tariffs that offer cheaper electricity overnight for charging your electric vehicle (EV). See what's available in our EV tariffs guide. 6. Struggling to pay your energy bills? Speak to your supplier about a payment plan or bill reductions. Plus most suppliers have hardship grants available for their customers, to help you get out of fuel debt. If you're really struggling, see our Help if you can't pay your bills guides. 7. Cut your bills by cutting energy use. Obviously, cutting use cuts bills - and hopefully there are cuts you can make to improve efficiency that don't affect your lifestyle too much. Plus many suppliers will actually PAY YOU to cut your energy use this winter. For full info, see 70+ energy saving tips | Energy mythbusters | Heat the human not the home. |

| We've had 14,000 responses to our "sorry, we are experiencing unusually high call volumes" tool... but need more. If you call a bank, broadband, mobile, credit card, energy, water or sewerage firm and hear something like this, please take 30 seconds to report it via our unusual call volumes tool (please bookmark this for when you need to use it). We think it may be a breach of the Consumer Duty and are building data. Megabus £2 coach tickets. 10,000 available - can you find 'em? For travel between 15 March and 15 April, though it excludes Northern Ireland and trips within (not to/from) Scotland. Megabus 'We got a £10,000 council tax refund thanks to MSE, as we care for our adult son.' Our success of the week comes from Paul and Pamela, who emailed: "Having read your severe mental impairments (SMI) article about council tax rebates, we contacted our council as we're both carers for our 35-year-old son who has cerebral palsy. We've just been issued a refund for the past 7yrs, amounting to almost £10,000, and had our council tax reduced by 50%. Thank you so much for bringing this to our attention." Also see: Council tax discounts and Are you in the wrong band? And please send us your MoneySaving successes (on this or owt else). 30+ birthday FREEBIES, including sweet treats from Krispy Kreme, Greggs, Costa & more. MSE turns 21 on Thursday, so we've updated our birthday freebies round-up, which works whenever you're celebrating. Happy birthday to us! 3,000 FREE pairs of Build It Live tickets (normally about £12 each). For Kent (24 to 25 Feb), Oxfordshire (8 to 9 Jun) and Exeter (7 to 8 Sept). Includes free £9.99 self-build guidebook. Build It Live |

| AT A GLANCE BEST BUYS

|

| THIS WEEK'S POLL How much do you typically spend on birthdays? In honour of MSE's 21st birthday this week (yippee!), we're updating our Birthday freebies guide - a round-up of the best goodies you can claim on your birthday. Yet while there are tons of free and cheap ways to treat yourself and others, the cost of birthdays can still add up. It leaves us wondering, how much do you spend on birthdays each year? Add up your own and other people's and vote in this week's poll. Over half of employees pay more than 8% of their income into their pension. Last week, we asked you how much of your pre-tax income you contribute to your pension each month. Over 8,000 MoneySavers voted, with roughly one in two employees paying in more than 8%, and one in eight paying in more than 20%. Fewer than 2% of employees don't contribute anything, compared to some 26% of those who are self-employed. See the full poll results. |

| |

|---|

| MONEY MORAL DILEMMA Should my son share the insurance payout from his mother's hospital stay with her? My son has private healthcare, which he pays £200/mth for and can add family members to for free. He added his mother, and a year later she had a badly-infected leg. The private hospital had no room, so she had to go to an NHS hospital, where she stayed for 12 days. My son's policy lets you claim £100/night if you have to use the NHS. His mother made a claim, and after she did all the paperwork, he was sent a cheque for £1,200. Yet he refuses to give her any of it, as he pays for the policy. Is he right or wrong? Enter the Money Moral Maze: Should my son share his insurance payout? | Suggest a Money Moral Dilemma |

| MARTIN'S APPEARANCES (TUE 20 FEB ONWARDS) Tue 20 Feb - The Martin Lewis Money Show Live (from Newcastle), ITV1, 8pm (watch previous episodes) |

| BUYING A PARAMEDIC COFFEE & A COCA-COLA PHONE - YOUR RANDOM ACTS OF MONEYSAVING KINDNESS That's all for this week, but before we go... it was Random Acts of Kindness Day on Saturday, so we asked our followers to tell us what random gestures of goodwill they've given or received. One person saw a paramedic pull up behind them in a Starbucks drive-thru and so paid for their order, while another gave their spare Edinburgh Castle tickets to some tourists, who then gave them £5 for some ice cream. When it comes to receiving, one MoneySaver asked a lady if they could park on her road and she responded by giving them a visitor permit. Finally, a few years ago a group of colleagues saved up ring pulls from cans to claim a free Coca-Cola phone for a fellow worker who didn't have a mobile - it even played the music from the Coca-Cola advert whenever someone called! See the full list, and let us know your random acts on Facebook, Twitter and Instagram. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email natwest.com, rbs.co.uk, santander.co.uk, chase.com, firstdirect.com, barclaycard.co.uk, tsb.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment