|

|

|

|

|---|

| DON'T believe the fake 'Martin Lewis' or 'MSE' ads |

|

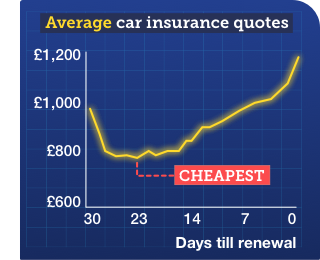

Price rises after 1 January rule changes are still expected for switchers. Insurers usually charged existing customers far more than switchers (who they pull in with big discounts). With the new equal pricing rules, the assumption is rates will meet nearer the middle, meaning, all else being equal, switchers' prices will rise. Yet January quote prices are only slightly up on December's. We've heard it's because insurers still have huge 'customer acquisition targets' to meet. But the spectre of price rises still looms, so EVERYONE - check now if you can save. How to cut the cost of car insurance... Here are the quick routes to drive down car insurance costs. Home cover is similar, but exact info's in Cheap home insurance.

|

| Is now the time to get solar panels? The copper lining of energy price rises is it makes solar panels more viable - if you've a suitable home, and savings. We've updated Are solar panels worth it for you? with new price-cap numbers. Got stamps that say '1st' or '2nd' class? Beware - they're going to become unusable. See how to save your stamps. Ends Sun. Got credit or store card debt? Shift it to 31 months 0% (2.7% fee) + get £25 cashback. A balance transfer's where you get a new card that clears old card(s) for you, so you owe it but at a cheaper rate. HSBC's 31-month 0% deal (2.7% fee, minimum £5)* is one of the longest 0% cards, yet as it gives £25 cashback if you shift £100+ until Sunday, for many that covers the one-off transfer fee. Key tip: Use our 0% eligibility calculator first to see if you'll likely be accepted for this and other cards. Key rules: Always repay at least the monthly minimum, and clear the card before the 0% ends, or it's 21.9% rep APR interest. Full help and more options in Top balance transfers (APR examples). Amazon £5 off £15 for some - do you qualify? See how to quickly check, plus 32 more Amazon tips & tricks. 1p Walkers crisps, 23p Irn-Bru & 90p Heinz mayonnaise via extra 10% off already-reduced 'past best-before' food. MSE Blagged. Approved Food sells groceries near or past 'best-before' dates at a discount (they're NOT past use-by dates so they're safe). Minimum £22.50 spend, delivery is £3+ or free for newbies. Approved Food New. Now switchers get a FREE £150 from First Direct, NatWest or RBS. Last week we told you the no.1 customer service bank First Direct* (90% polled rated it 'great') had upped its switching bonus to £150. Now First Direct's been joined by the RBS Reward account* - and its sister bank's NatWest Reward* already offered a free £150. With both, pay a £2/month fee and you get up to £5/month back (so a £36/year net gain), as long as you've two direct debits of £2+/month going out and you use its mobile app. Full account reviews and crucial eligibility info in Best bank accounts. 5 Odeon tickets for £25 (or 2 for £11) - can be used any day. This used to be a regular deal, then the pandemic hit. It's now back, till 1 March. You needn't use all tickets in one go. See this Odeon deal, plus 19 more cinema savers. New. Cheapest iPhone 12 contract we've seen - with 100GB data for '£30/month'. They're not MoneySaving, but if you want an iPhone 12, at least do it the cheapest way. Three newbies can get a 64GB iPhone 12* with 100GB/month of data for £89 upfront, then £26/month via Affordable Mobiles. That's £713 in total over the two-year contract - equivalent to £30/month and £540 cheaper than a similar deal from Three itself. Want a different handset? Use our Cheap Mobile Finder. Note: Three is responsible for the contract, Affordable Mobiles for the handset. UK base rates double, from 0.25% to 0.5% - what it means for mortgages & savings. Variable rate mortgages will rise roughly £12/month per £100,000 owed. For full info see our UK rate rises help. Energy change questions & student loan repayment hikes: Thu 8.30pm, ITV - The Martin Lewis Money Show LIVE. Over to Martin: "So much going on. I want to cover all your questions from last week's energy changes, plus I question the Chancellor over hidden hikes to student loan repayments. And no doubt lots more news you can use. See you Thursday - do watch us live and set your VideoPlus for the other side." |

| New. Top cash Lifetime ISA (for newbies & switchers)

|

| 20 tips to cut the cost of holidays abroad - flights, hotels, roaming, airport lounges, euros, insurance, school holiday hacks & far more. In case you missed them in last week's email, see our 20 holiday hacks. New. Will your water bill increase in April? Some to rise up to 10%. Some firms' prices are rising, others are falling, some staying the same. Find out Will my water bill rise and what can I do to stop it? 'I would've binned Barclaycard post refunding £1k if it wasn't for MSE.' Our success of the week comes from MoneySaver Debbie, who followed our tip to keep an eye out for Barclaycard sending refund cheques by post: "I received the 'circular' letter from Barclaycard and remembered your newsletter. £980 later and I want to thank you so much because I would have thrown it." Please send us your MoneySaving successes on this or anything else. Private parking ticket costs to be capped. New Government rules mean motorists will be charged no more than £50 in most situations, by 2024 at the latest. See Private parking charge cap. Related: Fight unfair private parking tickets, Fight unfair council parking tickets. How do you rate your broadband firm's service? Please vote now. It's our regular six-monthly poll on broadband firms. Please vote to help us help you and others decide who to use in future. Rate your broadband Ends Sat. Rare 5-day free trial for eHarmony premium. MSE Blagged. We've blagged a rare chance for you to try it, with no subscription. Gets unlimited messaging, video date feature and lets you see who's visited your profile. Normally £10/month. eHarmony |

| AT A GLANCE BEST BUYS

|

| CAMPAIGN OF THE WEEK Have you tried to get anything repaired, replaced or refunded since January 2020? Your consumer rights are enshrined in law, entitling you to a refund, repair or exchange if something's faulty, doesn't arrive or isn't what you thought you were buying. A group of MPs wants to hear about your experiences, plus whether you think complaining should be easier. Take their survey before it closes (5pm on Thursday). |

| THIS WEEK'S POLL How do you rate your broadband provider? We can tell you which are the cheapest broadband providers but to keep our customer service ratings updated, we need your help. Please rate your broadband provider on customer service (not price) over the past six months. Vote in this week's poll. |

| |

|---|

| MONEY MORAL DILEMMA Should I stretch my budget to have an expensive holiday lunch with my friend? I managed to get a good deal on the Eurostar to Paris and I'm now meeting a friend there. As we've not seen each other since before the pandemic my friend has suggested we go for a slap-up lunch but, while I'd really like to, it will mean spending a lot more than I've budgeted for. Should I just say yes as it sounds fun and we've not seen each other for such a long time, or say no because I can't really afford it? Enter the Money Moral Maze: Should I stretch my budget for lunch with a friend? | Suggest a Money Moral Dilemma |

|

| MARTIN'S APPEARANCES (WED 9 FEB ONWARDS) Wed 9 Feb - Ask Martin Lewis, BBC Radio 5 Live, 1pm. Listen to past episodes MSE TEAM APPEARANCES (SOME SUBJECTS TBC) Wed 9 Feb - BBC Radio Shropshire, Breakfast with Adam Green, from 9.15am, Gary Caffell on energy |

| SUPER MAGNETS & CSI TRICKS... WHAT'S THE SILLIEST WAY YOU'VE DESTROYED A BANK CARD? That's all for this week, but before we go... MSE Laura F asked on the forum for tales of debit card destruction and credit card catastrophes... and you didn't disappoint. One Forumite told us of the time they stood too close to a superconducting magnet at uni, wiping all their bank and access cards, while another attested to the destructive power of washing machines and tumble dryers. And we particularly enjoyed the wannabe-CSI star who used their card to try to help a neighbour break into their locked flat, only to mangle it beyond repair. Shake your head at more card carelessness - and add your own - in the What's the silliest way you've ruined a bank card? MSE Forum discussion. |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email sainsburysbank.co.uk, firstdirect.com, natwest.com, moneysupermarket.com, comparethemarket.com, gocompare.com, confused.com, directline.com, bank.marksandspencer.com, topcashback.co.uk, quidco.com, rbs.co.uk, affordablemobiles.co.uk, mbna.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment