- BIG Boxing Day sales, including Amazon, Ikea, John Lewis & more

- Energy bills UP 5% on Monday - your key need-to-knows

- Shift Christmas debt to 0% for 28mths

- £10 champagne & lots more... We hope you've had a wonderful Christmas, and you're enjoying time off with family (and plenty of leftovers...). Meanwhile, the hardworking elves at MSE Towers have been rustling up the last MoneySaving tips of the year - some are timely, some are just good ways to save if you've got a bit of time on your hands. So let us bellow these tips out, as the best way to spread MoneySaving cheer is shouting 'em loud for all to hear... - Boxing Day sales, including Amazon, Asos, Boots, Ikea, John Lewis & Next. Festive discounts are in full swing, and we expect many to be boosted further over the coming days. Get the latest in our full sales round-up & analysis, including what the 'up to XX% off' really means for each retailer.

IMPORTANT: Sales are great if you need something, it's discounted, and the store has the right size or model. But don't get sucked in by the hype. Before buying, remember Martin's Money Mantras: Do I need it? Can I afford it? Have I checked prices elsewhere? If the answer is 'no' to any of those questions, DON'T buy it.

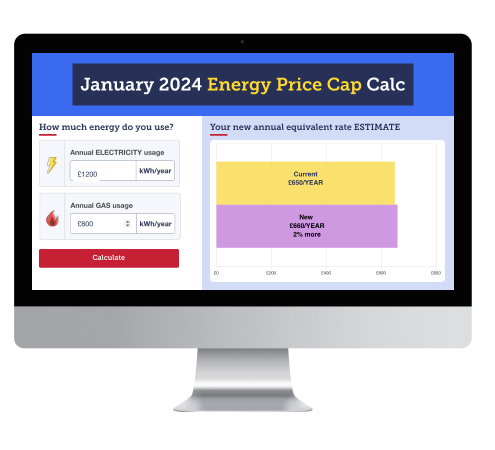

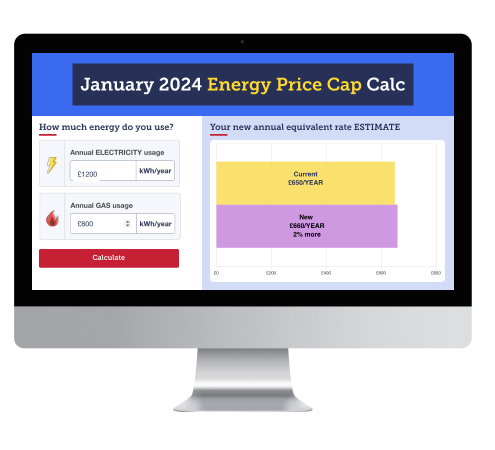

It's Meter Reading Week. Energy bills are going UP an average 5% on Mon 1 Jan - here are your key need-to-knows. On Monday, the new January to March Energy Price Cap kicks in, which dictates the rates that about 90% of homes (in Eng, Scot & Wal) pay. Rates will go up on average 5%, but the % increase you actually pay depends on where you live and how much energy you use. Our What'll I pay from Jan? calc gives a bespoke answer, or see full region-by region rates. For broad-brush, here are the average Direct Debit rates: It's Meter Reading Week. Energy bills are going UP an average 5% on Mon 1 Jan - here are your key need-to-knows. On Monday, the new January to March Energy Price Cap kicks in, which dictates the rates that about 90% of homes (in Eng, Scot & Wal) pay. Rates will go up on average 5%, but the % increase you actually pay depends on where you live and how much energy you use. Our What'll I pay from Jan? calc gives a bespoke answer, or see full region-by region rates. For broad-brush, here are the average Direct Debit rates:

GAS. Unit rate 7.42p per kilowatt hour (kWh), UP 0.53p (7.7%). Standing charge 29.60p per day, DOWN 0.02p.

ELEC. Unit rate 28.62p per kWh, UP 1.27p (4.6%). Standing charge 53.35p per day, DOWN 0.02p.

- It's Meter Reading Week. If you don't have a smart meter, or it doesn't work, take a meter reading ASAP (if after Monday, most firms let you backdate a few days). This reduces the risk of your supplier estimating that you'll use more at the higher rate than you actually do. Take a pic of the meter for extra peace of mind. See our firm-by-firm when & how to do a reading.

- Got a non-smart prepay electricity meter? If so, the price change tends to happen when you top up. So aim to top up more than you would normally (if you can) before 1 Jan, as any top-up after Monday will trigger you being charged the new higher rates. Full info in prepay top-up trick.

- Are you paying the right amount? Use our Direct Debit too high? calculator.

- Should you fix energy now? Based on the latest Price Cap predictions over the next 12mths, when energy prices are expected to fall, there are currently no fixes worth considering for most. Yet locking in a fix below Jan's rate would give you price certainty during winter, when you use the most energy - and predictions can change. Full details in our Should you fix energy? guide. Related: Not a fix, but there's a tariff from E.on Next that could be a winner for most, as it offers a 3% discount on the Price Cap. See Martin's E.on explainer.

- Eligible for the third and final 'benefits' cost of living payment? The final £299 instalment will be paid from Tue 6 Feb. See if you're eligible in cost of living payment and if you're struggling with energy bills, see what other help is available.

- Don't accept less than 5.2% interest on your savings. Rates continued to rise for much of 2023, though a hold in the Bank of England base rate led to a dip towards the end of the year. Overall, it's a good time for savers to check what they're earning - if it's less than 5.2%, it's time to ditch & switch...

- Top easy access: Metro Bank's 5.22% AER (min £500 - deposit within 28 days or get lower rate).

- Top one-year fix: Habib Bank Zurich UK's 5.5% AER (min £5,000).

Full info, plus non-standard accounts that may pay more, in top easy-access savings and top fixed savings.

- New. How would you fare taking Martin's Money Mastermind? In the Christmas special, Martin's podcast looks back at some of the best Money Masterminds of the year... would you fare better than Nihal at answering Martin's questions? Do listen to the new Martin Lewis Podcast via BBC Sounds, Spotify, Apple Podcasts & more.

Sign up for the FREE MSE Academy of Money course to sharpen your financial knowledge. If you've quiet time over Christmas you want to make use of, you could join 10,000s of others who have already signed up to our online financial education course (in partnership with the Open University). Sign up for the FREE MSE Academy of Money course to sharpen your financial knowledge. If you've quiet time over Christmas you want to make use of, you could join 10,000s of others who have already signed up to our online financial education course (in partnership with the Open University).

The course is free, available in English or Welsh, and covers six key areas of personal finance: 1) Making good spending decisions; 2) Budgeting and taxation; 3) Borrowing money; 4) Understanding mortgages; 5) Saving and investing; 6) Planning for retirement. Read all about it and see what other personal finance educational resources are available (including for kids) in our Financial education guide.

- Switch bank & get a FREE £175 plus TOP service. We've seen many (legal) bank bribes this year, with providers offering free cash and a variety of perks for your custom. These deals usually tail off around Christmas, and now there's just one left - but it's a good 'un...

Switchers to First Direct's 1st Account* get a FREE £175, access to a linked 7% regular saver they can put up to £300/mth in, and fee-free overseas spending on the debit card, plus many get a £250 0% overdraft (credit-check dependent). It's also been top or near-top of every customer service poll we've ever done.

Full info and eligibility criteria in FD review.

- New. Trick to get a £40 Asda voucher for £21. Newbies to Asda Mobile (uses Vodafone's network) can get 5GB of data for £7/mth - not the cheapest deal for this amount of data. But it's a 1mth contract, and auto-renew for 3mths and you'll receive a £40 Asda voucher (which can be used online or in store). You don't need to use the Sim, and can just cancel penalty-free, essentially giving you the voucher for half the price. Looking for a cheaper mobile deal? Use our powerful Cheap Mobile Finder.

Festive credit card debt piling up? Shift it to 0% for up to 28 months. If you pay interest on credit or store card debt, put your details into our Balance Transfer Eligibility Calculator to see your odds of getting a 0% deal. Festive credit card debt piling up? Shift it to 0% for up to 28 months. If you pay interest on credit or store card debt, put your details into our Balance Transfer Eligibility Calculator to see your odds of getting a 0% deal.

These cards pay off debt on old cards for you, so you owe the new one instead, but with 0% interest for a set time. If you've a choice, go for the card with the lowest fee which has a long enough 0% period for you to pay it off in. Top deals for accepted new cardholders include:

- The longest 0%: The two longest cards both offer 'up to' 28 interest-free months with very similar fees. However, if you're not pre-approved in our eligibility calculator, both could offer you less time at 0%. There's Barclaycard's up to 28mths 0%, 3.45% fee (some could get 14mths) and M&S Bank's up to 28mths 0%, 3.49% fee (some could get 20mths).

- The longest definite 0%: If you're not pre-approved for either of the cards above and don't want to risk getting a shorter 0% period, there's Santander's 26mths 0%, 3% fee. All accepted will get this deal, even if you're not pre-approved.

- If you can repay quicker: NatWest's 14mths 0% NO FEE. All accepted will get this deal, which is also offered by its sister banks RBS and Ulster Bank (though these don't feature in our eligibility calculator).

We've more options in Best balance transfers... though always follow the Golden Rules:

a) Clear the card before the 0% ends, or it's 23.9%+ rep APR interest.

b) Never miss the minimum monthly repayment or you can lose the 0%.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate.

d) You normally must transfer within 60 days to get the 0%.

- Struggling with debt? DON'T DELAY - get free help. If the cost of living crisis has left you feeling desperate about your finances, help is at hand. Several charities offer impartial, one-to-one help for FREE, but it's best to make contact ASAP as demand always soars in January. Full info's in our Debt help guide.

- £10 champers & £4.75 prosecco - great if you want to see in the New Year with bubbly. We've rounded up corking champagne & prosecco deals, but please be Drinkaware.

- Taken a seasonal job over the festive period? Check you haven't been UNDERPAID, as millions are. If you're making minimum wage (or a little bit more), it's worth double-checking if you're being paid properly - even big name brands get it wrong. There are seven things to check, all detailed in our Are you underpaid? guide, but here are the most common:

- Uniform, tools, safety clothing (or a Santa suit). If you must buy them, the cost shouldn't take you below the equivalent minimum wage. This is the most common failing.

- You should be paid for ALL working time. Including overtime, security checks, handover meetings, opening up, being on call & more. So if you get less than min wage once these are factored in, you're owed.

- Employers can't 'top up' with tips or overtime. These must be on top of minimum wage.

- Are you commission only? Employers must top up with a salary to meet the minimum wage if you don't earn it.

If you think any of these apply to you, check how to get back the money you're owed.

Oh Santa, why did you get me socks again? Your gift return rights. If the big fella got you something ghastly, misjudged your size or it broke on his sleigh, you may be in luck. Technically only the buyer has rights, but many stores allow recipients to get a refund or exchange with proof of purchase (which may mean awkwardly fessing up to the buyer). Full help in our Christmas return rights guide. Here's key info... Oh Santa, why did you get me socks again? Your gift return rights. If the big fella got you something ghastly, misjudged your size or it broke on his sleigh, you may be in luck. Technically only the buyer has rights, but many stores allow recipients to get a refund or exchange with proof of purchase (which may mean awkwardly fessing up to the buyer). Full help in our Christmas return rights guide. Here's key info...

- You've no legal rights to a refund or exchange if the gift was bought in a store (unless it is faulty). If the item doesn't work, you're due a refund. But if you just don't like it and it was bought in a shop, neither you nor the buyer are entitled to a refund. That said, many stores allow you to return non-sale items in good condition for about one month after purchase, whatever the reason, though you may need to settle for an exchange or store credit.

- If the gift was bought online, the buyer has the legal right to a refund. Essentially, they have 14 days after they receive their order to tell the seller they want a refund and a further 14 days to actually return the item.

- Many stores offer longer return periods over Christmas. For example, John Lewis is allowing shoppers to return items bought between 27 Sep and 24 Dec 2023 by 23 Jan 2024.

-

Can you save £670 in 2024 with the 1p Savings Challenge? A fun MoneySaving activity to kick off the New Year - it sees you save 1p on 1 Jan, 2p on 2 Jan, 3p on 3 Jan and so on. For full info, see MSE Molly MC's 1p Savings Challenge 2024 explainer. -

10 seriously MoneySaving successes, including £38,000 bereavement support, £2,000 student loan reclaim. Can they inspire you to save? In case you missed it, last week we shared some of the best successes from those who have followed our tips this year - to inspire and motivate you to do the same in 2024. BIG successes. |

No comments:

Post a Comment