| Plus... Green Homes update, cheap No7, Clubcard Prices extended  THE TOP TIPS IN THIS EMAIL

| | New. MSE Big Energy Switch 16

Super-cheap 15mth fixed gas & electricity deals from British Gas & Shell - save typically £290 over that time. These undercut almost every 1yr fix Lock in for longer, and for less, with our special deals  Winter's coming, and we're all set to be at home a lot more. That means higher energy bills. To help, we're launching our 16th MSE Big Energy Switch, where we lever our huge user base - the 7.5m who get this email and 4.5m Cheap Energy Club members - for super-cheap deals. Winter's coming, and we're all set to be at home a lot more. That means higher energy bills. To help, we're launching our 16th MSE Big Energy Switch, where we lever our huge user base - the 7.5m who get this email and 4.5m Cheap Energy Club members - for super-cheap deals. We've bagged 3 fixes (sadly not prepay and not available in Northern Ireland), meaning your rate's locked in, with no price hikes. Two last until 31 Jan 2022, ie, nearly 15mths. Shell at £842/yr on typical usage is the market's cheapest deal (barring two slightly cheaper 1yr fixes from tiddler firms with no feedback) and British Gas at £857/yr (newbies only) is the cheapest Big 6 deal.

Alternatively, if you want price certainty for longer, there's also the Green Network Energy TWO-year fix at £913/yr - the cheapest two-winter fix. Find choosing confusing? We can pick your winner

If you want help, rather than the product links above, which take you via a standard comparison, you can access these deals via our new whole-of-market tools. - Pick Me A Tariff for now. With this, you tell us your energy preferences (fix, name you know, service, green etc) and we use that to find your top pick based on those priorities, whether one of our special tariffs, which is likely for many, or another.

- Or better, Pick Me A Tariff every year (MSE Autoswitch). As well as picking your tariff as above, with this option we'll then autoswitch you when it's time to your new winner, based on those preferences, with just a one-click verification email.

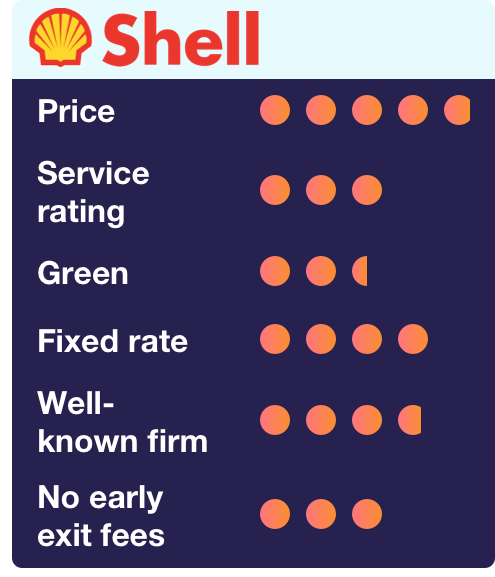

And the savings from switching are often huge, as Tasneem emailed: "I was with SSE for almost 9yrs... I decided to switch to British Gas and made a £600 annual saving. Wish I'd done it sooner. Thanks, MSE." Tariff prices vary by your use and location, so links go via our Cheap Energy Club comparison to ensure they're personalised for you, and up to date if the market changes. Use our Pick Me A Tariff or MSE Autoswitch comparisons if you need help choosing your winner. To get these deals, you need to have signed up to this email (ensure you log in using that email address) or have been a Cheap Energy Club member by 11.59pm on Mon 2 Nov. - MSE WINNER 1: SHELL ENERGY. Cheap 15mth fix + MSE enhanced service + 100% renewable elec. Price: £842/yr on typical use. Green: 100% elec, not gas. Service rating: 3.3/5 (decent). Save: £237/yr (see note below). 15,000+ available or ends Fri 20 Nov.

The Shell Energy Jan 22 v4 is a version of its already cheap standard fix, with an extra £25 bill credit and the usual £25 MSE cashback (£12.50 bill credit and £12.50 cashback for single elec). We include this in the price so it's £50 cheaper. The Shell Energy Jan 22 v4 is a version of its already cheap standard fix, with an extra £25 bill credit and the usual £25 MSE cashback (£12.50 bill credit and £12.50 cashback for single elec). We include this in the price so it's £50 cheaper.

The fixed rate (not the price, that varies by use) lasts until the end of Jan 2022, so you're price-protected this winter and some of next.

Shell is one of the largest providers outside the Big 6 (it used to be called First Utility). On annual cost, it's only beaten by two 1yr fixes from small firms with no feedback. We've arranged 'MSE enhanced service' for this deal, which means if it isn't helping you, contact us so we can escalate issues (pls talk to it first though).

Who can get it? New and existing dual-fuel (ie, gas & elec) and elec-only custs

Smart meters? Not required - though it'll contact you about them.

Renewable? 100% renewable elec, but gas isn't green

Early exit fees? £30/fuel (unless within 49 days of the fix ending)

Payment? Monthly direct debit only

Comparison link above: Filtered to exclude all but decent service, fixed-rate results (you can undo the filters)

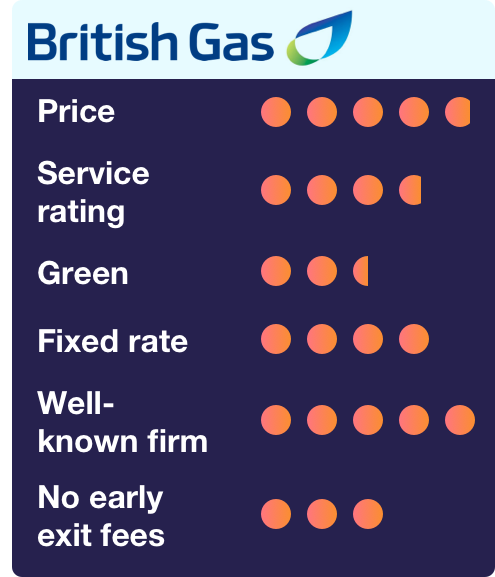

- MSE WINNER 2: BRITISH GAS. Cheapest Big 6 fix (lasts 15mths) + 100% renewable elec + 1yr's free heating insurance. Price: £857/yr on typical use. Green: 100% elec, not gas. Service rating: 3.9/5 (decent) - not MSE-enhanced. Save: £222/yr (see note below). Ends Fri 20 Nov.

Many of you tell us you want the safety of a big name. So we've also bagged this British Gas Exclusive Protection Jan 2022 dual-fuel deal, available to those who aren't currently British Gas customers. It's the cheapest Big 6 deal, plus you get the usual £25 MSE cashback. Many of you tell us you want the safety of a big name. So we've also bagged this British Gas Exclusive Protection Jan 2022 dual-fuel deal, available to those who aren't currently British Gas customers. It's the cheapest Big 6 deal, plus you get the usual £25 MSE cashback.

Like Shell, the fixed rate (not the price, that varies by use) lasts until the end of Jan 2022, so you're price-protected this winter and some of next.

It includes a year's 'free' heating, plumbing and electrical insurance if you don't already have its cover, which will auto-renew at £12/mth after a year - we'll send you a reminder beforehand so you can decide whether to continue or not.

You MUST agree to get free smart meters (one for gas, one for elec) installed if you don't have 'em already (unless it's impossible to fit them), within 3mths of switching.

Who can get it? New dual-fuel custs

Smart meters? Required if possible, but they're free

Renewable? 100% renewable elec, but gas isn't green

Early exit fees? £60 (unless within 49 days of the fix ending)

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but big name deals (you can undo the filters)

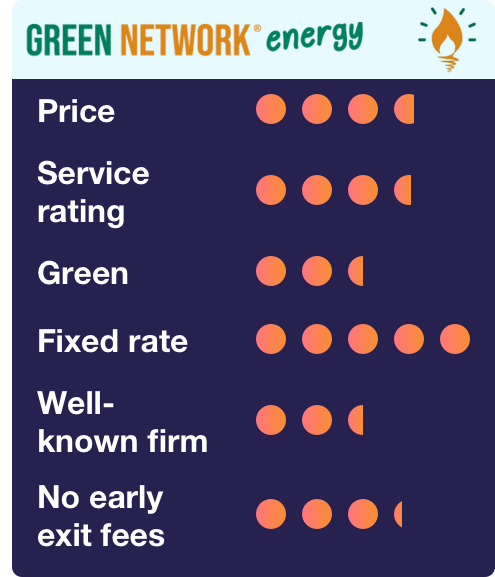

- MSE WINNER 3: GREEN NETWORK ENERGY. Cheapest TWO WINTER fix + 100% renewable elec. Price: £913/yr on typical use. Green: 100% elec, not gas. Service rating: 3.6/5 (decent) - not MSE-enhanced. Save: £332/yr over 2yrs (see note below). Ends Fri 20 Nov.

This Green Network Energy 2 Year Green Fix dual-fuel and elec-only deal, available to new customers only, is the cheapest 2yr fix on the market, including the £25 MSE cashback (£12.50 elec-only). The fixed rate (not the price, that varies by use) lasts for 24mths from the day you switch. This Green Network Energy 2 Year Green Fix dual-fuel and elec-only deal, available to new customers only, is the cheapest 2yr fix on the market, including the £25 MSE cashback (£12.50 elec-only). The fixed rate (not the price, that varies by use) lasts for 24mths from the day you switch.

This is the best deal for those who don't like switching often or are worried about future prices and want certainty now. It's about £90/yr more expensive on typical usage than the market's cheapest, but you get this price locked in for two winters.

Who can get it? New dual-fuel and elec-only custs

Smart meters? Not requiredRenewable?100% renewable elec, but gas isn't green

Early exit fees? £25/fuel (unless within 49 days of the fix ending)

Payment? Monthly direct debit

Comparison link above: Filtered to exclude all but longer fixed deals (you can undo the filters)

- Not on direct debit or live in Northern Ireland? You can still save. We try to get non-direct debit deals but providers aren't usually keen to offer them. However, that doesn't mean you shouldn't act.

- Not on direct debit? If you're not on a prepay meter, the cheapest thing to do would be to switch to monthly direct debit, as the cheapest tariffs are offered this way. If you're not happy to do that, you can still do a comparison based on your current payment method.

- Prepay customers: Try our prepay comparison - savings are smaller, typically £80+/yr, but it could still be worth doing. For bigger savings, see if you can switch to a credit meter. See Cut prepay energy costs.

- Northern Ireland: Our Cheap Energy Club, like all UK comparison sites, doesn't currently include Northern Ireland, but you can do a comparison via Cheap NI Electricity or the Consumer Council for Northern Ireland's tool. -

An important note about how we work out your savings. When we tell you your annual savings, we do it for someone who uses a typical amount of energy, according to regulator Ofgem, and who is currently paying the energy price cap rate which millions do.

Yet right now, in some ways that's misleading, as the current energy price cap, which started in Oct and lasts 6mths, is low because of the lockdown. While that's good news, it artificially reduces annual savings, as next March's cap is likely to jump.

As we're already in the period where data is collected to set the price cap, energy analysts at Cornwall Insight say it's currently predicted to rise by about 6% - £63/yr higher.

So when we note savings above, we've factored that in and compared the price you get with the estimated typical price cap over the next year (ie, 5mths at current cap, 7mths at future).

However, when you do a comparison via Cheap Energy Club, it's based on the current, lower price cap - so your real savings are likely to be bigger than it tells you. Here's a quick Q&A - for more, see the full Cheap Energy Club FAQs.

Q. Is switching risky? Could I be cut off? No, as no one visits your home (unless you want a smart meter) and it's the same gas, same electricity and same safety. The only things that change are price and service. See our 'Switching is no biggie' FAQs.

Q. Does MSE make money from this? Yes, as like all energy comparison sites, we're paid each time you switch through us, yet we give you roughly half as cashback (that's £25 dual-fuel, £12.50 single-fuel). This is money you wouldn't get if you went direct (not that the deals above are available directly anyway). So it's a win-win. The rest helps cover our costs and hopefully makes us some profit. More switching and energy help in the links below... Switching with smart meters | Why's my price risen when I'm fixed? | Reclaim credit | Switching-in-debt help | Switching if I've solar panels | How direct debits are set | Can I pick a switch date? | How do you compare my rates? -------------------------------------------------- The lockdown lowdown: what you need to know

The Martin Lewis Money Show LIVE, 8.30pm Thu, ITV

This week, I'll be focusing on the lockdowns affecting most of the UK and the new rules for furlough, the self-employed, mortgage holidays and more. Give me half an hour, and I'll ensure you know everything you need, to help yourself and those you love.

And of course, you can tweet suggested questions to @MartinSLewis, but you must use the show's hashtag #MartinLewis. Do tune in or set the Betamax. | | DON'T believe the fake 'Martin Lewis' or 'MSE' ads

Lots of scam ads litter social media and even newspaper websites - some of these lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | Martin's 13 NEW coronavirus need-to-knows, incl... Furlough's back | Rehire & furlough | Bigger self-employ grant & uni credit change | 6mth mortgage hols | Renters' help | Bounce-back top-ups | 729,000 claim work-from-home tax back | Travel refunds | Wedding help & more

A few months ago, the sun was shining and I had a hope, albeit forlorn, I'd written my last big 'new Covid need-to-knows' briefing. Yet t omorrow (Thu) England joins Wales & NI in a form of lockdown. And the financial landscape is thus rapidly changing. So I need to do it again. As it's changing so fast, I'm going to give headlines here with links to our full info which we're updating as it happens. All are UK-WIDE unless stated... A few months ago, the sun was shining and I had a hope, albeit forlorn, I'd written my last big 'new Covid need-to-knows' briefing. Yet t omorrow (Thu) England joins Wales & NI in a form of lockdown. And the financial landscape is thus rapidly changing. So I need to do it again. As it's changing so fast, I'm going to give headlines here with links to our full info which we're updating as it happens. All are UK-WIDE unless stated... 1) Furlough extended a month - even for those not furloughed before. Furlough means the state pays the wages of employees who have no work or who can't work. It was due to end on 31 Oct, but on Sat was extended until 2 Dec (so far). It'll stay at 80% of wages up to £2,500/mth for unworked normal hours but you can work part-time too. All employees who were on a payroll submitted to HM Revenue & Customs (HMRC) before 31 Oct can be furloughed. It's all at the employer's discretion, though. Full details in furlough extension. STOP PRESS: This includes those on the payroll on 23 Sep made redundant since - they can be rehired and furloughed at the employer's discretion. 2) Self-Employment Income Support Scheme (SEISS) grant 3 increased to 55% of profits - applications open 30 Nov. SEISS 3 was set to be 40% of trading profits, to cover Nov to Jan. Now, to match furlough, the Govt's upped it to 80% just for Nov. In total that means over the 3mths it's worth 55% (still less than grant 1's 80% and grant 2's 70%), up to a max £5,160. Only those eligible for the earlier grants are eligible for this - so the excluded are still excluded. Full info: SEISS grant 3. 3) Automatic up-to-6mth mortgage payment holidays on again - but ONLY do it if needed. The mortgage holiday regime ended on Sat. Yet regulator the Financial Conduct Authority (FCA) has launched a tick-box consultation which means it almost certainly will return next week. It'll mean those struggling financially due to Covid who haven't had a mortgage payment holiday can near-automatically get one for 3mths, then another after 3mths. Those who have already had one can extend/do it again up to a total 6mths.

Officially the FCA is saying not to contact lenders until it's all confirmed, however of the 13 major lenders we checked with, 10 still have active online portals, letting you apply for holidays now, and most have told us it's OK to do so. See which lenders are currently offering online mortgage payment holiday applications. WARNING: Remember interest is still charged, and while it won't go on your credit file, it can still affect your creditworthiness. See my updated Should I take a payment holiday? blog.

4) Card, loan, car finance and other payment holidays likely to be coming back too. Officially these ended last Sat too, but the FCA is looking to extend. Updates in my Should I take a payment holiday? blog. 5) Had to work from home, even for A DAY, since 6 Apr? Join the 729,570 who have claimed tax relief for the WHOLE YEAR. Three weeks ago I blogged that HMRC had launched a system letting people easily claim a year's tax back for working from home, even for a day. It went ballistic, both here and on my show. So much so, a little HMRC birdie's told me by Sun pm 729,570 had signed up. 6) Phew. Good news for the self-employed on uni credit - the min income floor's temporary removal has just been extended. At the pandemic's start, the Govt removed the universal credit (UC) 'min income floor' until 13 Nov. Recently the spectre of its return was so worrying, I suggested you write to your MP to ward it off. Thankfully the Govt's just confirmed it's extended until Apr 2021. The floor means the self-employed are assumed to earn at least roughly min wage when calculating their UC. Without it, those earning less are assessed on actual income - so get more help. See min income floor extended. 7) Renters who need help - speak to your landlord. Plus evictions 'shouldn't' happen in lockdown in Eng & Wal. Many landlords with mortgages should be able to get a mortgage payment holiday if their tenants are struggling to pay. Have the conversation if you're struggling. At the other end - if your landlord wants to evict you now, you must usually be given 6mths' notice (12wks in NI). If you've already been served notice, and the landlord's got a court eviction notice, while there's no hard rule, it's likely the Govt will ask bailiffs not to evict people during lockdown from tomorrow (Thu) in Eng, as they've done in Wales. Full info: Rental help.

8) Bounce back loan top-ups now allowed. Bounce back loans allow businesses to borrow up to 25% of annual turnover (max £50,000) on exceptional terms. From next week, those who didn't take the full amount first time will be allowed to borrow more. Full info and updates in Bounce Back Loans. 9) Shielding's not returning in Eng - what to do? The 'clinically extremely vulnerable' are being told not to go to work even if they can't work from home. If so, ask to be furloughed - if not, are you due statutory sick pay?

10) Holidays will be banned for those in Eng from Thu. Trips within the UK and to go abroad won't be allowed. When airlines and package holiday firms cancel trips, you are due a full refund. Yet if they keep flying, eg, Ryanair, legally they needn't pay you (check travel insurance but few now cover for Covid). Full help for Eng and other UK nations in our Travel Rights guide. 11) Many locked-down gyms are pausing memberships and shops are extending return rights. See gym lockdown policies for info and our store-by-store return rights list for which shops are extending the time you have to return goods. 12) MOTs aren't being extended and house moves can still go ahead. This time lockdown's not changing everything - see the latest on everything from rail refunds to supermarket rationing in our Life in Lockdown guide. 13) Weddings in Eng banned during lockdown. Plans scuppered? See Wedding Rights. For more, all the latest info goes in our constantly updated, in-depth Covid help guides on... | Get EARLY access & 10% more off Soap & Glory bundle, so £78 worth costs £27. It's one of the big Boots Star Gifts every year that MoneySavers wait for. The set - incl mascara, body lotion and shower gel that has £78 worth of items - goes on general sale next week for £30, but you can get on a waiting list NOW to get it for £27 and get it a day early (useful as it sometimes sells out fast). Soap & Glory Ends 8pm Wed. New, rare 10% deposit mortgage if you're buying a home - any good? Yorkshire Building Society has launched a short-lived deal that, rarely these days, only requires a 10% down-payment (not available for remortgaging - ie, switching deal). Is it any good? See 10% deposit mortgage analysis. Ends 11.59pm Wed. ShopDisney (formerly Disney Store) 24% off code for full-price toys, incl Frozen, Toy Story & more. This is the strongest code it tends to release each year, but it's short-lived. ShopDisney Watch Martin's 'How to be successful - 10 things your kids (and maybe you) should know'. Martin's one-off ITV doc is now on YouTube. Part biography, part education - finance, work, life, grief and more. When it was broadcast a year ago some wanted to show it in schools - now you can see 10 things. No Green Homes Grant installers near you? Try its 'find an installer' tool again. The Govt tells us it's updated its tool, adding more installers, and now the tool will only show installers within 30 miles (if it shows further, it says it's likely the head office of a firm operating locally to you). Full help in our updated Green Homes Grant guide. | Ho-ho-hurry. Two banks will pay you £100 or more to switch to them in time for Christmas, but one ends Monday. So check now

Banks are willing to bribe you to switch to 'em, and it's all legal - so if you want some free cash, bag it. Four are currently paying, though only two pay out quickly enough for it to come before Christmas, and one of those is ending soon. To get the cash, you'll need to use the banks' official switching services. The switch itself will be done within 7 working days, and all direct debits and standing orders will be moved for you, the old account closed and any payments to it auto-forwarded. Banks are willing to bribe you to switch to 'em, and it's all legal - so if you want some free cash, bag it. Four are currently paying, though only two pay out quickly enough for it to come before Christmas, and one of those is ending soon. To get the cash, you'll need to use the banks' official switching services. The switch itself will be done within 7 working days, and all direct debits and standing orders will be moved for you, the old account closed and any payments to it auto-forwarded. You'll need to pass a credit check, but it's usually not too harsh. Full info on all the accounts, and other perks you may prefer, in our Best Bank Accounts guide, but here are the deals that you need to ho-ho-hurry for... - HSBC - free £125, which should arrive by mid-Dec, plus 2.75% savings. Newbies can switch to the HSBC Advance account* and get £125 roughly 30 days after the switch completes. It also gives access to its 2.75% fixed regular saver, where you can save up to £250/mth. On customer service, HSBC's rating from our Aug 2020 poll is a decent 47% 'great'.

To qualify, you'll need to pay in a min £1,750/mth, which is just its way of saying "pay your salary in" (equiv to £25,600+/yr), and switch 2+ direct debits/standing orders across. Also, you can't have held an HSBC account (or opened a First Direct or M&S Bank account - they're part of the same group) since 1 Jan 2017.

- Ends 11.59pm Mon. Lloyds - free £100 which should arrive by mid-Nov, plus other freebies, eg, 12 movie rentals. Newbies starting a switch to Club Lloyds before Mon get a free £100, which comes about 10 working days after the switch starts. The account also pays 0.6% AER interest on up to £4k and 1.5% on any balance between £4k and £5k. Plus you get a choice of four annual benefits: 12 movie rentals, 6 cinema tix, a magazine subscription or Gourmet Society membership. Meanwhile, Lloyds's customer service rating is a slightly better 56% 'great'.

You need to pay in at least £1,500/mth (equiv to a £21,200/yr salary) to avoid a £3/mth fee and you need to pay out 2+ direct debits/mth for the interest. Plus, you won't get the £100 if you've had switching cash from Lloyds since April 2018. | £68ish of No7 make-up for £24. Incl mascara, eyeliner, lip gloss and more. Delivery's £3.50. Latest Boots Star Gifts Tesco up to 50% off 'Clubcard Prices' extended to incl veg, snacks, cereal, skincare, booze etc. Initially it was only on frozen items but now it's been extended and incl many big brands. See Clubcard Prices analysis. 12 FREE ways to learn something new at home, incl languages, beauty tips, coding & more. With so many of us at home for longer, we're reminding you of this mega-popular blog to keep yourself busy and boost your skills too. Free ways to learn at home EXTRA 30% off already reduced Adidas, Timberland, Hunter wellies, Vans & more shoes. MSE Blagged. Via Shoeaholics outlet code till Thu. Also includes some Kurt Geiger and other designer brands. Step this way 50% off ALL cards online at Scribbler. MSE Blagged. Quirky cards for every occasion, incl photo cards. Our code makes 'em half-price, eg, the cheapest option is £2.35 delivered first class. 10,000 available. Scribbler 'I reclaimed £1,100 after overpaying my student loan in FOUR different years - thanks MSE.' MoneySaver Michelle says the cash will tide her over while she's between jobs. Check if you can reclaim | Tell your friends about us They can get this email free every week | SUCCESS OF THE WEEK:

"I submitted a claim to the Valuation Office at the end of August for a review of my council tax band. I will be receiving a refund of over £3,500. Nice Christmas present - m any thanks."

(Send us yours on this or any topic.) | THIS WEEK'S POLL Have you haggled with Sky, BT, the AA or others this year? Did you succeed? Haggling can result in big savings - on anything from digital TV to breakdown cover. Each year we try to gauge the success rates of those who have done it. Let us know how you've got on in this week's poll. Cash ISN'T king for most MoneySavers. Last week, we asked how often you now use cash - over 10,500 people responded. The results suggest cards are fast supplanting cash, with 56% saying they rarely or never use it. Not everyone is cashless just yet though - 53% of over-65s said they still pay with it at least half the time. See full cash poll results. | Soap & Glory - £78ish of bath & beauty products for £27

No7 - £68ish make-up set for £29

ShopDisney - 24% off full-priced toys, ends Wed

Shoeaholics - Extra 30% off Adidas, Hunter, Vans etc

Scribbler - 50% off all greetings cards | | | MARTIN'S APPEARANCES (WED 4 NOV ONWARDS) Thu 5 Nov - This Morning, phone-in, ITV, 10.55am

Thu 5 Nov - The Martin Lewis Money Show, ITV, 8.30pm

Mon 9 Nov - Ask Martin Lewis, BBC Radio 5 Live, 12.20pm MSE TEAM APPEARANCES (MOST SUBJECTS TBC) Thu 5 Nov - BBC Radio Leicester, Mid-morning with Ben Jackson, Oli Townsend on TV MoneySaving, from 11.35am

Mon 9 Nov - BBC Radio Manchester, Drive with Phil Trow, from 2.25pm

Tue 10 Nov - BBC Radio Cambridgeshire, Mid-morning with Jeremy Sallis, from 12.20pm | 'I STILL MISS PICK 'N' MIX FROM WOOLIES' That's all for this week, but before we go... rumours that Woolworths was returning to UK high streets sparked a social media frenzy last week, and while not true, MoneySavers responded with a flood of nostalgic posts. It appears many have fond memories of the famous chain which closed its stores in 2009, with highlights including its pick 'n' mix sweets, Ladybird clothing range and its walls stacked high with CDs (remember them...?). Take a trip down memory lane in our Woolworths nostalgia Facebook post. We hope you save some money, stay safe,

The MSE team | |

No comments:

Post a Comment