| Hi - here are your latest deals, freebies, tricks and messages to help you save.  THE TOP TIPS IN THIS EMAIL

| | Martin's debt masterclass

Slash ALL debt costs. Can't afford to clear 'em? You can't afford not to try to move 'em to 0% Credit cards, overdrafts, mortgages, personal loans, store cards, student loans and payday loans  Debt can be depressing, dangerous and debilitating. If you're dreading this month's bills dropping through the letterbox, don't wait to deal with it - that just means interest will keep accruing. The priority is to try to reduce the interest you pay. This means more of your repayments clear the actual debt rather than just cover the interest, so you can be debt-free quicker. So it's time for my annual interest-cutting masterclass and this year it's even more important, as costs are rising - eg, the new normal for overdrafts is to be a stomach-churning 40% annual interest.

Of course, you also need to try to stop increasing your borrowing too - if not you risk a debt spiral. If you're very worried about your debts, jump straight to points 8 and 9 below. A balance transfer is where you get a new card to repay debt on old credit and store cards, so you owe it instead but at 0%. The length of top 0% deals is shorter than a year ago, and I don't see things improving, so if you've debt to shift, it's best to act quickly. The impact can be large, as Sarah discovered: "@MartinSLewis Got your email today, it reminded me to balance-transfer - I'm now saving £60 a month [£720/yr] in interest. Thanks." - Don't just apply. First find which cards will accept you. Our eligibility calc shows your acceptance odds, helping you minimise applications and protect your credit score. - Which card wins? Go for the lowest fee in the time you're sure you can repay in. Unsure? Play safe and go long. | TOP NEW-CARDHOLDER BALANCE TRANSFER CREDIT CARDS | CARD

| 0% SHIFT DEAL, FEE (1) & APR AFTER | HOW GOOD IS ITS DEBT SHIFT DEAL? | New. Sainsbury's (eligibility calc / apply*)

| - Up to 29mths 0%

- 2.74% one-off fee, min £3 (2)

- 19.9% rep APR after | Lowest-fee long 0%, but it's an 'up to', so you could be offered fewer 0% months. | Virgin Money (eligibility calc / apply*)

| - 29mths 0%

- 3% one-off fee

- 21.9% rep APR after | Slightly higher fee, but not an 'up to' so if accepted you def get 29mths 0%.

| Barclaycard (eligibility calc / apply*)

| - Up to 28mths 0%

- 1.75% one-off fee

- £20 cashback if you shift £2,500+

- 21.9% rep APR after

| Best if you're shifting £2,500+ to get cashback. If not, cards above beat it.

| Santander (eligibility calc / apply*)

| - 18mths 0%

- NO FEE

- 18.9% rep APR after

| Strong contender if you can clear debt within 18mths as no fee, & those accepted def get the full 0% length.

| Barclaycard (eligibility calc / apply*)

| - Up to 18mths 0%

- NO FEE

- £20 cashback if you shift £2,500+

- 21.9% rep APR after

| If you can repay quickly & shift £2,500+ it can beat Santander, due to the cashback, but is an 'up to' 0%.

| | (1) % of debt shifted. (2) Initial 3% fee, refunded to 2.74% within 60 days. |

Always follow the Balance Transfer Golden Rules:

a) Clear the debt or shift again before the 0% ends or you'll pay the APR.

b) Never miss the min monthly repayment or you can lose the 0%.

c) Don't spend/withdraw cash. It usually isn't at the cheap rate.

d) Usually you need to do the transfer within 60 days to get the 0%. Full help and info in Best Balance Transfers (and see APR Examples). Overdrafts are changing. Under new rules from regulator the FCA, which come into effect in April, banks must charge interest for arranged overdrafts, rather than daily fees or other charges. Its aim is to make things more transparent, which it has succeeded in, and to foster competition, which it's fallen flat on its face in doing. That's because, as each big bank announces its new rates, of those we know so far, RBS, NatWest, Santander, First Direct, HSBC, Nationwide and M&S Bank are all 39.49% or 39.9% EAR variable, while Barclays is not far behind at 35%. See a bank-by-bank list of new & old overdrafts. For more, watch my ITV overdraft changes show from Mon. Here are brief tips. a) Switch to a 0% overdraft. Accepted switchers to First Direct* ( eligibility criteria ) get a free £100 and many get an ongoing £250 0% overdraft. So if your overdraft's up to £350, this pays off some of what you owe and the rest is at zero interest. Go above that and from March you'll pay the new 39.9% rate (15.9% EAR variable before). Alternatively, Nationwide FlexDirect* ( eligibility criteria ) offers some a bigger 0% overdraft for a year (39.9% EAR variable after), though the size depends on your credit history. So use this as respite and aim to clear it before then. If you've a friend with an account, you can both gain via its recommend-a-friend scheme if you switch. b) Use a 0% money transfer credit card. For larger overdrafts, a few specialist cards also allow 'money transfers' - where the card pays cash directly into your bank account, clearing your overdraft, so you owe it instead. You can get up to 28mths 0% for a 4%-ish fee. Full help and best buys in 0% Money Transfers which includes our eligibility calc. As Baby 2 Sleep tweeted me yesterday as I was writing this: "@MartinSLewis Thanks for the advice on your prog last night. Just done a money transfer to clear the overdraft. 23mths 0%. Much better than getting stuck from April with big interest rates. Never thought of it b4." c) Can't get a better deal or struggling? Ask for help. The FCA says firms must ensure customers are treated fairly. So if you've a big overdraft, can't switch, and it's causing you problems, especially if it's due to the changes in rates, make a formal complaint that you're not being 'treated fairly' and then, if it fails to help, take it to the Financial Ombudsman. For far more help, see our 12 Overdraft Cost-Cutting Tips. If you've a loan, the big question is, can you get a new one to clear it and pay less? This one's more difficult, but it can work. MoneySaver Marian emailed us: "Thanks. Got a 3% loan to pay off a 15.9% one, saving £3,000+. I recommend you to my friends."  As there can be early repayment charges if you repay a loan early, it's not just about comparing APRs. Here's what to do... - STEP 1: Ask your current lender for a settlement figure. This is how much it'll cost to repay your loan in full now, including any early repayment costs (ie, the amount you'd need a new loan for to pay off your old one). - STEP 2: Work out how much it'll cost you to stay where you are. Check what your monthly repayments are and how many you have left (ask your lender if you don't know). Then multiply them to see the cost if you stick. - STEP 3: Find the cheapest new loan for the settlement figure. For borrowing under £3,000, the cheapest way is likely a 0% money transfer (see above). For more, or if that doesn't work, you usually need a new loan. Our Loans Eligibility Calc shows your likely cheapest. Or below there are the best buys - they're all 'rep APR' though, meaning sadly only 51% of accepted customers need get the advertised rate - others may be charged more. For £3,000-£4,999, Admiral* is 8.2% rep APR, Hitachi* 8.5% rep APR. For £5,000-£7,499, Admiral* is 3.4% rep APR, Tesco* 3.5% rep APR. For £7,500-£15,000, Cahoot* is 2.8% rep APR (though it's hard to get); Yorkshire*/ Clydesdale Banks* and M&S Bank* are all 2.9% rep APR. See our Cheap Loans guide for more help and deals. Also see Rep APR Examples. - STEP 4: Find out which is cheaper. Use the MSE Loan Switching Calculator to see whether you should stick or not. Mortgage rates are super-cheap right now, so this is a very good time to check if you can switch and save. Many who have moved off a fixed or discount deal are now paying well over 4%, yet currently you can get 2yr fixes from 1.15% and 5yr fixes from 1.4%. As Christine tweeted: "@MartinSLewis Just saved £340 a month [£4,000/yr] by switching our mortgage deal." For full help, get our free 66-page remortgage booklet (there's also a first-time buyers' booklet). But super-briefly... - Benchmark your cheapest rate using our Mortgage Best Buys tool. - Consider using a mortgage broker to find the best deal, as they have information about acceptance chances not available to the public. - Use our Ultimate Mortgage Calculator to work out savings, compare deals, see the gain from overpaying and more. If you've other types of expensive credit, it's important to deal with them quickly - the exact options depend on your circumstances, so see our Payday Loan Help guide for what to try. If you previously had a payday loan and couldn't afford it, check if you can reclaim payday loans.  In many cases, while it's counter-intuitive, unless you're a BIG earner you're actually better off just to leave it. However, it depends which type of loan you have, which depends on when you started. In many cases, while it's counter-intuitive, unless you're a BIG earner you're actually better off just to leave it. However, it depends which type of loan you have, which depends on when you started. - Started uni 1998 - 2011 anywhere or a Scottish/NI student in 2012+? See my 'Should I clear my Plan 1 student loan?' video.

- Eng/Welsh & started uni in 2012+? See my 'Should I clear my Plan 2 loan?' guide. It's not just about moving your debt to where it's cheapest. Whether you're accepted for cheap deals or not, the aim should always be to pay as much off as you possibly can as quickly as you can (without damaging your financial stability). There are a few things that help with this...

a) Prioritise repaying the highest-interest debt first... it grows fastest. List all debts in order of APR (highest first). Then use all spare cash to clear that and just pay minimums on everything else. Once it's clear, focus on the next costliest.

This is key now that overdrafts are moving to 40% as standard - double a typical credit card's interest. If it's your costliest debt, prioritise reducing your overdraft even if that means just paying the min on credit cards. See which debt to repay first.

b) Got savings? Use 'em to clear costly debts. Many people are emotionally attached to seeing savings in the bank - but it's often the wrong call if you've costly debt. See Repay debts or save? and Should I overpay my mortgage?

c) Do a budget and manage your money. Get control of your spending - do a budget to see where the cash is going. Then set up the piggybanking system to control your spending. d) Boost your credit score. You'll be eligible for better debt cost-cutting deals in future. Join our Credit Club for a personal prescription. If things are tough, the solutions I have put above about cutting cost may not be right for you - especially if any of the following apply...

- You can't meet minimum monthly payments.

- You have non-mortgage debts bigger than a year's salary.

- You have sleepless nights or depression/anxiety over debt. If so, get free, one-on-one debt-counselling help from Citizens Advice, National Debtline or StepChange. They are there to help, not judge. The most common thing I hear after is: "I finally got a good night's sleep." And do BELIEVE THINGS CAN CHANGE. Read inspiring stories in our Debt-Help forum and also see our Mental Health & Debt guide. Full info: Debt Crisis Help. ____________________________ Introducing the Rate-o-meter - max every penny of savings interest The Martin Lewis Money Show, ITV, 8pm Mon

It's a savings special next Monday. The top fixed, easy-access and regular savings rates have all been cut recently. Most people are earning disgracefully low amounts. So the aim's to have every penny saved count - to help I've come up with a Rate-o-meter to show how you can earn up to 50% risk-free. Do watch, or set the Betamax. | | DON'T believe the fake ads on Facebook

Lots of scam ads that litter social media lie that we or Martin promote Bitcoin, binary trading etc. See Fake ads warning. | 100+Mb (FAST) b'band & line '£19/mth' - we've never seen cheaper Virgin's revived its mega-popular superspeed deal + 1m of its existing customers to get 'free' speed upgrade We always say the secret to slashing broadband & line costs is to pounce quickly on hot, short-lived promos, and this week it's about speed in more ways than one. That's because Virgin has brought back its mega-fast 108Mb-speed broadband deal - seriously fast for mainstream, domestic broadband - and 55% of households can get that and a phone line for a year for less than a BT phone line alone. Here's how it works + other top deals at slower speeds.

- As always, these short-lived deals (listed in speed order) are for newbies. As they're postcode-dependent (eg, only 55% can get Virgin) links go to our Broadband Unbundled tool to check your eligibility. If you can't get 'em, we list alternatives. | TOP B'BAND & LINE DEALS FOR NEWBIES (1) | | DEAL | EQUIV COST (2) | HOW IT WORKS | | Cheapest superfast fibre b'band + line | | | '£18.75/mth' MSE Blagged | New. Apply via this special Virgin Media link by Thu 23 Jan and you'll pay £25/mth over the 1yr contract. But you get an auto £75 bill credit, so there's nothing to pay for 3mths. That makes it £225 in total, equiv to £18.75/mth. | | Cheapest fast-fibre b'band + line | | 63Mb | '£17.45/mth' (or '£15.45/mth' for some) | Ends Fri. Apply via this Vodafone link by Fri and it's £23/mth, which is £414 over the 18mth contract. But you can claim a £100 Amazon, Currys PC World, J Lewis or M&S voucher. If you'd have spent that anyway, the effective total cost is £314, equiv to £17.45/mth. Already a Vodafone pay-monthly mobile cust new to its b'band? The same deal is £2/mth less. | | 38Mb | | New. Apply via this Post Office link and it's £20.90/mth. That's £250.80 over the 1yr contract. But claim a £50 Amazon vch and, if you'd have spent that anyway, it brings the total effective cost down to £200.80, equiv to £16.74/mth. | Cheapest standard-speed b'band + line

| | 11Mb | | Apply via this Shell link by Sun 2 Feb and it's £17.99/mth. Yet you get a £75 auto bill credit within 3mths, making it £140.88 over the 1yr contract, equiv to £11.74/mth. | | (1) Definition of newbie differs by firm - see exact terms via the links. (2) To compare, we use 'equivalent prices' - adding all fixed costs, deducting promo cash or vouchers and averaging it over the contract. | - Existing Virgin customer? You'll get a 'FREE' speed upgrade. If you get less than 108Mb avg speed b'band, you'll automatically get a boost to that level by the end of March, with no change to your price or contract term. But as many people pay far more than the prices above, don't rest on your laurels. If out of contract and you want such fast speed, Virgin is likely your only option but it's still worth haggling (help below). For slower, switch to one of the other deals above.

- Other b'band tips & tricks which can save you £100s...

- What speed do you need? Standard avg 10/11Mb is often fine for browsing or light streaming. Fibre is best for streamers, gamers or if many use it at once in your home. Yet there are also various fibre speeds - see speed help.

- Will I get the average speed? It's what 50%+ of customers get at peak times, so not necessarily. You're also told the minimum before you sign up by some firms (incl Virgin from those above). See how to check your speed incl your rights if you fall short of the min.

- Don't want to switch? Haggle. Switching gives the best savings, but big broadband firms are some of the easiest to haggle with. Full info and help in Broadband Haggling. | Martin: 'Santander 123 is now a dead duck as it slashes savings interest & cashback.' Big changes are coming from May as it cuts savings to 1%, limits cashback and sets a new 40% overdraft rate. See our Ditch Santander 123? analysis. 16 easy freebies incl beer, tea, photo prints and make-up. See January freebies. EDF joins British Gas by cutting prices to offer EXISTING customers £300/yr off (if you know how to get it). Don't like switching energy firm? There's good news as some Big 6 suppliers offer cheap deals that allow existing customers to get 'em (as well as newbies), so many can stick with the same company and pay far less. Yet you can't call them up to apply, they're only via comparison sites. Our switch without switching comparison shows your firm's top deal, and EDF and Brit Gas custs (not prepay custs) can now save £300/yr on typical bills. Sacha tweeted: "I've been with British Gas for 15 years, but I'll save £433/yr staying with British Gas. Thank you." Or save up to £350/yr switching firm: Just do a full comparison. 'Secret' shoe outlets, eg, £21 Puma trainers (norm £62). Some high street chains flog slightly scuffed and ex-display footwear online at huge discounts via little-known outlets, but stock's limited. Walk this way for how to find 'em Top easy-access savings - 1.35%. Rates are dropping like flies, with last week's top 1.4% rate now gone so we're reminding you as we don't know how long today's table-toppers will last. They're Marcus* (part of investment banking giant Goldman Sachs) at 1.35% AER variable on a min £1, and Ford Money (yes, the car giant's bank) with exactly the same deal. Full info and more help in Top Savings. Stuck with an expensive mortgage? Mortgage prisoner group launches legal action. Full info & how to sign up in mortgage prisoners latest. | For 15yrs we've told you of the split ticket train trick that can save £100s. Now Trainline's launched a tool, but there's better & cheaper

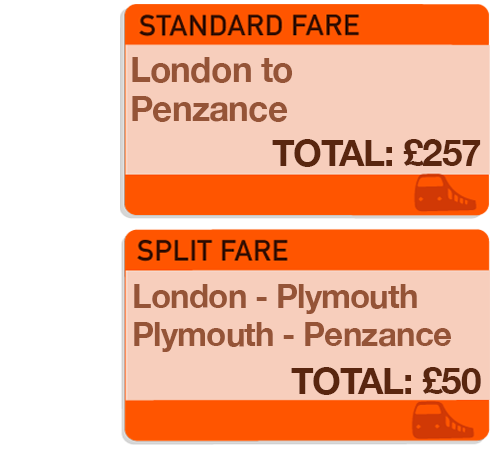

Over the last week there's been big coverage of the largest train site, Trainline, launching a split ticket tool, as if it was novel. Split ticketing lets you get the SAME train, at the SAME time, but pay less. We've covered it in this email as far back as 2005, when Martin explained: "Buying tickets for a journey's parts cuts cost, eg, a London-Penzance standard return is £257. Yet the train stops in Plymouth. Buy London to Plymouth & Plymouth to Penzance returns for just £50 in total. Saving £207." In 2012, we launched our TicketySplit tool, but we closed it in 2018, as others had built tools we thought were niftier. Over the last week there's been big coverage of the largest train site, Trainline, launching a split ticket tool, as if it was novel. Split ticketing lets you get the SAME train, at the SAME time, but pay less. We've covered it in this email as far back as 2005, when Martin explained: "Buying tickets for a journey's parts cuts cost, eg, a London-Penzance standard return is £257. Yet the train stops in Plymouth. Buy London to Plymouth & Plymouth to Penzance returns for just £50 in total. Saving £207." In 2012, we launched our TicketySplit tool, but we closed it in 2018, as others had built tools we thought were niftier. - We've analysed 10 split ticket sites - Trainline's costlier and not as good. We've spot-checked prices for 15 journeys across 10 split ticket sites this week, factoring in fees. Full results in top split ticket sites, here are the headlines:

| TOP TRAIN SPLIT TICKET SITES | | NAME | FEES + EASE | HOW CHEAP IS IT & HOW MANY SPLITS PER JOURNEY (1) WILL YOU SEE? | | | Free. Only shows splits on desktop site and app (not on mobile site), but tricky to find on both as only visible after pressing 'book', with mixed Trustpilot reviews. | Cheapest for 7 out of 15 journeys. On all fares you'll see a simple option of two tickets per journey if that's cheaper, but you may also see extreme splits with multiple changes or different departure times if that's even cheaper.

| | | Charges 10% of your saving if you book with it. Works on desktop and mobile site (there's no app). Easiest to use by far. | Cheapest for 2 out of 15 journeys. If it's cheaper to split, you'll get one option on all fares and what you see will be the cheapest avail even if it's multiple tickets for the same train. | | | Charges £1.50 for bookings under £100, £6 over. Works on desktop, mobile and app but slow and clunky. | Cheapest for 5 out of 15 journeys. If it's cheaper to split, you'll get one option on all fares (except anytime fares) and what you see will be the cheapest avail even if it's multiple tickets for the same train.

| | NOT A TOP PICK - HERE FOR COMPARISON | | | Charges £1.50 per booking. Only avail as an app. Fairly quick & responsive. | Cheapest for 0 out of 15 journeys. On all fares you'll see a simple option of two tickets per journey if that's cheaper. | | Won't work on season tickets. (1) Journey classed as going from A-B, normally on one train, but can be multiple trains where no direct route available. All sites show multiples journey departure times, eg, the 7pm to Manchester, 8pm to Manchester etc. |

- Split ticketing is bizarre, but legal. It makes about as much sense as a hot dog-flavoured lollipop, yet it works and is legit due to our bizarre rail system. As Darryl tweeted on Mon: "@MoneySavingExp. Saved £128.97 on two tickets from Pitlochry to London using the MSE guide only last week, about a 35% discount."

Do note if you're doing it yourself, the train MUST call at all stations you buy tickets for, and if you need to change trains and have bought a ticket for a train at a specific time to continue your journey, if the first train is delayed, your ticket for the second may be invalid.

- Other ways to save on trains... It's not just split ticketing - there are lots more tips in our Cheap Trains guide, incl:

- Book 12+ weeks ahead. That's when cheapest advance fares go on sale - set up a free alert for your route.

- Buy an advance ticket on the day. Some are sold just 10 mins before departure. Book early, late

- Check two singles and returns. Logic dictates returns should be better value, but often aren't. Singles vs returns | Tell your friends about us They can get this email free every week | Warning. Booking a hol? Get travel insurance ASAB - As Soon As you've Booked. Cheapest incl annual trip, over-65s & pre-existing conditions If you're one of millions booking right now, don't delay on the insurance or you lose half its worth We need to be blunt. Every year, someone emails us something like: "I've just found I've got cancer, I've treatment lasting three months, I'm due to go on holiday, but they won't refund me." It's upsetting and frustrating but is exactly what travel insurance is for. Yet many leave getting insured till just before they go. So although they're covered while away, if something stops them travelling, be it illness or death in the family, they're uncovered. This is easily fixable - just by ensuring you buy insurance as soon as you book. That's why we warn about it every January - the biggest holiday booking month. Full info in Cheap Travel Insurance, here are the key tips: -

Holidaying more than once a year? Then usually annual travel insurance wins, as it covers unlimited numbers of trips, but capped at 17 to 90 days per holiday. Full options and choices in Cheap Annual Travel Insurance, but deals include: Holidaying more than once a year? Then usually annual travel insurance wins, as it covers unlimited numbers of trips, but capped at 17 to 90 days per holiday. Full options and choices in Cheap Annual Travel Insurance, but deals include:

- Cheapest no-frills annual policies. These meet our minimum cover criteria but are based purely on price, not factoring in payout record or service. Coverwise Bronze* and Leisure Guard Standard* tend to be cheapest for under-65s, eg, a 30-yr-old individual in Europe pays £9, a family worldwide £72.

- Want high-end protection? Our top pick is LV Premier*, based on what it covers, feedback and past payout record. It's £71 for a 30-yr-old individual in Europe, £198 for a family worldwide.

- Just going away once? Single-trip policies from £6 in Europe, £18 worldwide. If you just want the cheapest - not factoring in payout record or service - expect to pay from £6 for a 7-day trip to Europe for an individual and from £38 for a family with worldwide cover for a week. Full help, including higher-end protection, in cheapest single-trip cover, but briefly, Leisure Guard*, Coverwise* and Insurefor.com* tend to come up cheapest for most simple options.

- Over 65? Don't get fleeced by sky-high costs. Prices can rocket. Yet if you know where to look, those visiting Europe (who have a European Health Insurance Card) can get it from £38/yr if aged 66, from £67/yr aged 76 and from £81/yr aged 80. For full help and where to look, incl worldwide cover options, see Over-65s' Travel Insurance.

- Have medical issues? Always declare 'em. Again, it can be pricey, but a 50-yr-old with high blood pressure could get annual Europe cover for £23/yr. See pre-existing medical conditions help.

- Claim turned down or unhappy with your insurer? These firms aren't perfect - it's one of the reasons we call some of them no frills. So remember if you're unhappy or don't feel you've been treated fairly, then make a formal complaint. If they reject it, you've a right to go to the free Financial Ombudsman Service.

| COUNCIL TAX WIN - SUCCESS OF THE WEEK:

"Thank you for the useful article on council tax rebanding. We submitted a claim and had a refund of close to £9,000, which was backdated to the early 1990s. In the future we pay less too. "

(Send us yours on this or any topic.) Want an MSE Charity grant of up to £7,500? Non-profit organisations can benefit from a cash boost in our charity's latest grant-giving round. It's themed on 'living with long-term challenges' - so it's for groups that may, for example, help teach financial skills to people with learning difficulties - and opens for applications on Mon 3 Feb. To find out if your organisation's eligible, you can take an eligibility quiz and apply via the charity's website. The round closes once it accepts 40 applications or on Fri 28 Feb, whichever comes first. | THIS WEEK'S POLL How much data do you use on your mobile? With the growing use of social networks, plus streaming, gaming and more all done on mobiles, we wanted to see how much data you crunch in a month (via a 3G, 4G or 5G signal, not Wi-Fi). How much mobile data do you use? Ipostparcels bottom of the pile in our parcel delivery poll. Last week, we asked you to rate parcel delivery services - more than 9,000 of you voted. This year, Ipostparcels came last, with 42% rating its service 'poor' and only 13% 'great'. Last year's wooden-spoon holder Yodel wasn't far behind, at 46% 'poor' and 21% 'great'. At the other end of the scale, DPD came top, with 63% rating it 'great' and 11% 'poor'. See full parcel delivery poll results. | MONEY MORAL DILEMMA Should I have refused to pay again for my shopping? I paid for lunch at a supermarket self-service till by scanning its payment app, so it automatically charges my credit card and awards me loyalty points. I got the usual instant notifications (from that app and my credit card app) that the payment went through - but the till said it didn't. I alerted staff who insisted I pay again and told me I'd get an automatic refund if there was an eventual double charge. I paid again, but should I have kicked up more of a fuss? Enter the Money Moral Maze: Should I have refused to pay again for my shopping? | Suggest an MMD | View past MMDs | MARTIN'S APPEARANCES (WED 15 JAN ONWARDS) Thu 16 Jan - Good Morning Britain, ITV, 7.35am

Fri 17 Jan - This Morning, ITV, 10.30am

Mon 20 Jan - This Morning, ITV, 10.30am

Mon 20 Jan - BBC Radio 5 Live, Lunch Money Martin, 12.20pm. Listen again

Mon 20 Jan - The Martin Lewis Money Show, ITV, 8pm MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 15 Jan - BBC Radio Cumbria, Money Talks with Ben Maeder, from 6pm

Fri 17 Jan - BBC South West stations, Good Morning with Joe Lemer, from 5am, Guy Anker

Mon 20 Jan - TalkRadio, Breakfast with Julia Hartley-Brewer, 9.45am, Oli Townsend

Mon 20 Jan - BBC Radio Manchester, Drive with Phil Trow, from 5.45pm

Tue 21 Jan - BBC Radio Cambridgeshire, Lunchtime Live with Jeremy Sallis, 2.20pm | QUESTION OF THE WEEK Q: Is it true energy suppliers have to reimburse account balances within a given period after you switch to another firm? Colin, via email.  MSE Andrew 's A: Current rules require energy suppliers to refund any credit you have on your account within 10 days of sending you your final bill. If they don't, you're entitled to £30 automatic compensation. Unfortunately, there's no firm rule on when suppliers must send final bills. Regulator Ofgem requires them to "take all reasonable steps" to send them within six weeks of a switch, though there are no penalties if it's later. MSE Andrew 's A: Current rules require energy suppliers to refund any credit you have on your account within 10 days of sending you your final bill. If they don't, you're entitled to £30 automatic compensation. Unfortunately, there's no firm rule on when suppliers must send final bills. Regulator Ofgem requires them to "take all reasonable steps" to send them within six weeks of a switch, though there are no penalties if it's later. Don't let this put you off switching as you should always get your credit back eventually. So to see if you can save £100s/yr by switching, do a full Cheap Energy Club comparison. Please suggest a question of the week (we can't reply to individual emails). | WHICH IS THE BEST SEAT ON THE TRAIN? That's it for this week, but before we go... a tweet asking which seat on an empty New York subway train is the best to pick recently went viral - so we thought we'd do our own version for a UK train carriage. We asked MoneySavers which of six seats they'd choose - the two window seats were the clear winners, though some preferred those next to the aisle. Not everyone was satisfied with just one though - one reply flippantly asked to take up three adjacent seats, arguing "comfort can only be found from a horizontal position". Look at the pic and have your say on our Train seat debate Facebook post. We hope you save some money,

The MSE team | |

No comments:

Post a Comment