|

| - | - | - | - | - |

| |

|

|

|---|

| DON'T believe the fake ads on Facebook |

| New. Big FREE cash for switching bank is back - get £200 It's been a quiet summer for new bank bribes but a biggie is back with a bang - paying up to £200 if you switch and stay. And that's not all, as the top service bank has boosted the freebies it gives switchers. This comes in the week of the 5yr anniversary of the official Current Account Switch Service - under which switching takes 7 working days and the new bank moves all direct debits etc. So here are the top bribes to take advantage of... (All require you to pass a not-too-harsh credit check.)

Full info and more options in Best Bank Accounts, incl lots more on how easy it is to switch. |

| Ryanair U-turn as 2 million can now escape new baggage charge - but millions more will still be hit. See full help to check your Ryanair hand luggage allowance. Asda to scrap price match scheme... marking the end of 'wombling'. Full info incl how long you've left to earn & use vchs. Asda la vista 10 FREE postcard-size photo prints, incl free del. Good for holiday pics. Snap 'em up Huge British Airways data breach - what you should do. Worryingly, 380k card details were stolen. BA help New. NHS free prescription checker. Do you qualify for free meds? See free prescription checker. |

| |

|---|

| New. British Gas customer? No-brainer £200/yr off If you're one of 3.5m on British Gas's expensive standard tariff, be warned - your price will rise for the 2nd time this year on 1 Oct by an avg 3.8%. So someone on typical use will pay about £350/yr more than the market's cheapest (compare to find your cheapest). Yet for those who don't like to switch firm (far better if you do), the giant's just launched an easy way to slash costs without switching - it's also the cheapest big-name deal for many. But if you don't ask, you don't get...

|

| Wetherspoon pubs - 7.5% off for one day. On everything in Eng, Wales and NI - but not alcohol in Scotland. See when you can get a rare Wetherspoon discount. Please be Drinkaware. 36 alpine tulip bulbs + four pots £15 all-in. MSE Blagged. Two varieties, 4,500 sets avail. Park Promotions FREE gym passes, incl DW Fitness First, Anytime Fitness & Nuffield Health. Plus free boot-camps, outdoor classes and how to haggle with gyms. Let's get physical Ends Sat. No contract, 8GB, unltd mins & texts Sim: £15/mth + £20 Amazon vch. This pay-as-you-go deal from Smarty* (uses Three's network) is cheap and refunds £1.25/mth per unused 1GB, so use 2GB and you effectively pay £7.50/mth. You're also emailed a £20 Amzn vch within 3mths, provided you activate the Sim and make three monthly payments. Full help in PAYG Sims. While this Sim gives flexibility, standard contract Sims can be cheaper. Mr Men: The Complete Collection - code gets 50 books for £23 delivered (norm £30). MSE Blagged. Also Little Miss 37-book collection for £16 delivered (norm £28). Ends Mon. The Book People 'Free' pizza or carvery at 90+ Stonehouse restaurants (norm up to £10ish). When you buy a drink. 'Free' Stonehouse |

| AT A GLANCE BEST BUYS

|

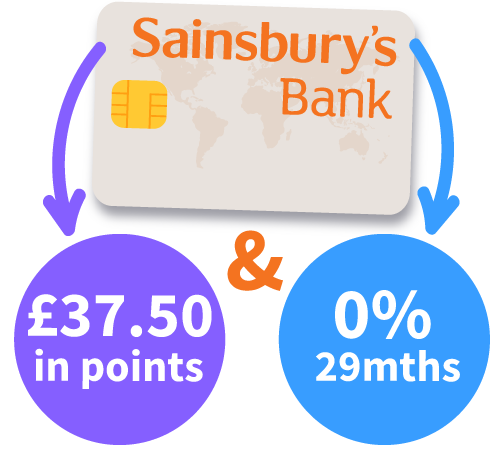

| New. One credit card deal that works one of two ways (or both)... 1. FREE £37.50 Sainsbury's trick 2. The LONGEST interest-free spending card, 29mths 0% This is a bit of a hybrid credit card: good if you're a Sainsbury's shopper keen for extra points, or if you're looking to borrow the cheapest way... or both. But as we always say, NEVER use such cards as an excuse to overspend or fill income gaps.

|

| 10,000 FREE Grand Designs Live Birmingham tickets. For 10-14 Oct, norm up to £20. Grand Designs £200 BROADBAND HAGGLE - SUCCESS OF THE WEEK: Five Plain Lazy T-shirts £35 via code (norm £110). MSE Blagged. Lucky dip design, men's or women's. Plain Lazy |

| CAMPAIGN OF THE WEEK Got a question about your pension, or just want to know how to start saving? If you can get to Leicester, Cardiff, Reading or London this week, you can jump aboard a double-decker bus packed with pension experts for free guidance and info. Check out the Pension Awareness Day website for its timetable - if you can't catch it, our Personal pension need-to-knows guide has plenty of info too. |

| THIS WEEK'S POLL Have you haggled with Sky, BT, the AA and more this year? Did you succeed? Haggling with service providers can net big savings - on anything from digital TV to insurance. So please let us know if you've gained cheaper prices, extra goods or better deals. Have you successfully haggled this year? Many parents aren't allowed to buy cheap school uniforms. State primary schools have the most relaxed requirements, with a third allowing parents to buy uniform from supermarkets - compared with just 6% of private primary schools. In contrast, seven in 10 secondary schools (state or private) insist parents have to buy everything from a specific supplier. See full school uniform poll results. |

| MONEY MORAL DILEMMA Would it be OK to pay off our mortgage with our son's money if his Premium Bond won? We've just had our first child and his grandparent has given him £1,000 in Premium Bonds. It's unlikely, but if he actually won big, would it be wrong if we paid off our mortgage with the money? He'll inherit our house one day after all. Enter the Money Moral Maze: Is it OK to pay off our mortgage with our son's winnings? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: Using LISA to pay off debt |

|

| |

|---|

| MARTIN'S APPEARANCES (WED 12 SEP ONWARDS) Thu 13 Sep - Good Morning Britain, ITV, Deals of the Week, 7.40am MSE TEAM APPEARANCES (SUBJECTS TBC) Wed 12 Sep - BBC Cumbria, Money Talks with Ben Maeder, from 6pm |

| QUESTION OF THE WEEK Q: I'm moving home in a few weeks - how do I make sure I'm not charged for energy used after I move out? Peter, via email.

Then take opening meter readings for your new home so you're only charged for what you use there. Plus, do a comparison via our Cheap Energy Club to get on the best deal in your new place - you'll usually be put on a 'deemed contract' with the existing supplier to the property, often an expensive standard tariff. Please suggest a question of the week (we can't reply to individual emails). |

| MY LANDLORD WANTED £100 TO REPLACE A LIGHTBULB... AND £50 TO CLEAN IT. WATT THE...? That's all for this week, but before we go... how many landlords does it take to change a lightbulb? Serious question. Our very own MSE Callum was quoted the ridiculous prices above but being a savvy MoneySaver, he at least got them down to £35, and saved on other hefty charges. Do you have stories of similar rip-offs and did you successfully challenge them? Read Callum's lightbulb rip-off story and share your tales in the comments section of his blog. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email moneysupermarket.com, confused.com, comparethemarket.com, gocompare.com, autoaidbreakdown.co.uk, hsbc.co.uk, firstdirect.com, bank.marksandspencer.com, smarty.co.uk, mbna.co.uk, santander.co.uk, aviva.co.uk, sainsburysbank.co.uk, Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment