|

| - | - | - | - | - |

| |

|

|

|---|

| DON'T believe the fake ads on Facebook |

| Your favourite banking apps - ALL with good cash or spending perks A huge 22m regularly use one. And the top apps come with fee-free spending abroad and/or cashback In our two recent banking-app polls, Starling and Monzo were in the top positions both times. They're app-only banks with debit cards but no branches, and their apps offer the usual features (eg, transferring cash) with added gizmos. Plus they have good perks - as does our polls' next best, NatWest. So if your bank's app-alling, and a good mobile experience matters, here are the accounts with top apps and hot perks. If you don't care about apps, you can get bigger bonuses on traditional accounts, as stated below. And as we always say, switching's easy.

|

| How to get 10p/litre off Tesco petrol & diesel. Useful as prices are among the highest in 4yrs. See Cheap Petrol. New. £25 cashback when you shift debt to 32mths 0%. Transfer a £100+ balance to this M&S card (eligibility calc / apply*) and you're charged a fee of 0.99% of the amount transferred (min £5). But newbies who apply by 31 Aug and transfer by 31 Oct get £25 - which cancels out the fee on sub-£2,525 balances. Always pay the minimum each month and clear the card before the 0% ends or it's 19.9% rep APR. Full info and more options in Balance Transfers (APR Examples). 100+ supermarket coupons worth £100+ incl £2.50 off Krispy Kreme, free iced drink. We've done the legwork as they're harder to find these days. 100+ coupons Driving in Europe this summer? Full help incl equipment needed, insurance, speed limits. See our NEW Driving in Europe guide. |

| |

|---|

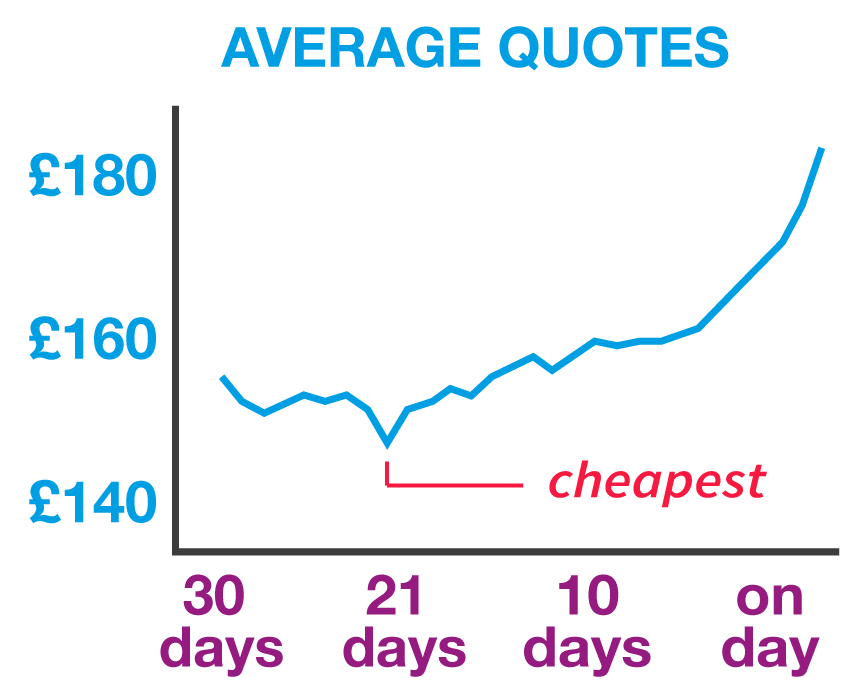

| Revealed: The best time to get home insurance We revealed last week it's best to buy car insurance three weeks before it starts or renews. Today we show it's the same for home insurance. That's based on analysis of 3m+ quotes from Jan-June we requested from the four comparison sites listed below. While 21 days ahead is best, average prices are still good 17-30 days ahead, as explained in our home insurance price probe. Use our cheap home insurance system to save - here are the basics...

|

| Urgent. Beat BT's broadband, phone & TV price hike. It's hiking prices on Sun 16 Sep - the perfect trigger to switch if you're overpaying. If out of contract you can leave penalty-free, but if tied in, you must have told BT you're leaving within 30 days from when it notified you, to escape without charge. Some will have missed the boat and while the window's open for others, it won't be for long. Use our Broadband Unbundled tool and see if you can slash costs. Use contact lenses? Trick to get 'em 20% cheaper. See cheap contact lenses. Childcare vouchers scheme closing to new applicants - could be worth £100s. Check if childcare vouchers win for you and slash childcare costs. 'Sunbelievable' sunflower plant £6 delivered (norm £20). MSE Blagged. Can produce 1,000+ blooms. 9k avail. Cheap flowers New. Cheap high-data Vodafone Sims, incl unltd mins & texts + 20GB for '£11/mth'. While these are decent value, they're only for data gobblers, as 4GB costs £8/mth. Over the 1yr deal via these links, Vodafone newbies pay £20/mth for 20GB* or £25/mth for 40GB* - but claim a £110 Amazon vch, and if you'd spend it anyway, they're equiv to £10.84/mth or £15.84/mth. Full help in Cheap Sims. Diary of a Wimpy Kid - code gets 12 books for £11 delivered. MSE Blagged. Norm £18ish. Read all about it |

| AT A GLANCE BEST BUYS

|

| We've hit peak travel season and with it a wave of flight cancellations and delays has caused misery for thousands of holidaymakers. But if you've been delayed, the silver lining is you could be owed big compensation. There's full info in our Flight Delay guide with free reclaim tool, which'll help if you've been hit - or you can brush up on your rights in case it happens in future. Here's our checklist:

|

| Discounted full Sky Sports, £179 for 10mths. Timely with the football season under way. It's via Sky's Now TV streaming service - you don't need a Sky or any other digital TV box - but it's not in HD. It's equiv to £17.90/mth, which is MUCH cheaper than via Sky directly. Cheap Sky Sports MASSIVE PPI WIN - SUCCESS OF THE WEEK: "Finally got round to completing my PPI claim from two banks using your templates. Got £18,500 in total with just a couple of hours' work. Thanks." (Send us yours on this or any topic.) Karen Millen 25% off EVERYTHING code. MSE Blagged. Includes sale, ends Sunday. Karen Millen Free Homebuilding & Renovating Show tickets. 21-23 Sep at ExCel London plus other locations in the coming months. 3,000 pairs avail, norm £8-£12. Homebuilding & Renovating |

| THIS WEEK'S POLL When did you last move your savings? Savings rates have crept up slightly since last week's base rate rise. If your savings earn less than 1%, it's time to move (see Top Savings Accounts). Yet we know switching savings isn't everyone's top priority, even though we'd urge you to think again. When did you last move your savings? The majority of MoneySavers use a specialist travel card or cash to spend abroad. In last week's poll, we asked how you usually spend overseas. More than a third use a top travel credit card, which is one of the cheapest ways. Getting cash in advance was popular among under-25s, with four in 10 preferring this method. See full spending abroad poll results. |

| MONEY MORAL DILEMMA Should I be compensated for buying work items in my time? I regularly use my cash to buy items I need for work, then claim it back. My employer reimburses me for the cost but not the time or travel. Yet it often takes lots of time, and I pay petrol and car running costs to get them. Enter the Money Moral Maze: Should I be compensated for buying work items in my own time? | Suggest an MMD | View past MMDs THE QUICKIES - Debt-Free Wannabe chat of the week: August's Bring Your Lunch to Work |

|

| MSE TEAM APPEARANCES (SUBJECTS TBC) |

| QUESTION OF THE WEEK Q: I'm selling my house and I have an early repayment charge on my mortgage. This is unfair as I'm not moving to another mortgage but paying mine off. Is there any to avoid it? David, via email.

Yet it's worth chatting through your circumstances with your existing lender and a good mortgage broker in case it's a hefty charge that could be avoided. For instance, if you're buying another home, you may be able to transfer your existing mortgage to that property (known as porting), rather than repay it and incur the early repayment charge. Not all mortgages are portable though, and you would of course still pay interest if you kept the mortgage, plus other fees to move it, so carefully check it adds up in your favour. See our Cheap Mortgages guide for more help. Please suggest a question of the week (we can't reply to individual emails). |

| 'I HAVE A STASH OF PUREES AND JAMS FROM 2012 WHICH ARE STILL FRESH' That's all for this week, but before we go... preserving seems to be a big hit on the MSE Forum and MoneySavers are discussing the benefits of this way to reduce wastage and stock up for less. One of our favourite responses is a stash of purees and jams which are still lid-popping fresh - from 2012. Are you a preserving enthusiast? Share your treasures in our preserving forum thread. We hope you save some money, |

Important. Please read how MoneySavingExpert.com worksWe think it's important you understand the strengths and limitations of this email and the site. We're a journalistic website, and aim to provide the best MoneySaving guides, tips, tools and techniques - but can't promise to be perfect, so do note you use the information at your own risk and we can't accept liability if things go wrong. What you need to know This info does not constitute financial advice, always do your own research on top to ensure it's right for your specific circumstances - and remember we focus on rates not service. We don't as a general policy investigate the solvency of companies mentioned, how likely they are to go bust, but there is a risk any company can struggle and it's rarely made public until it's too late (see the Section 75 guide for protection tips). We often link to other websites, but can't be responsible for their content. Always remember anyone can post on the MSE forums, so it can be very different from our opinion. Please read the Full Terms & Conditions, Privacy Policy, How This Site is Financed and Editorial Code. Martin Lewis is a registered trade mark belonging to Martin S Lewis. More about MoneySavingExpert and Martin LewisWhat is MoneySavingExpert.com? Who is Martin Lewis? What do the links with an * mean?Any links with an * by them are affiliated, which means get a product via this link and a contribution may be made to MoneySavingExpert.com, which helps it stay free to use. You shouldn't notice any difference; the links don't impact the products at all and the editorial line (the things we write) isn't changed due to them. If it isn't possible to get an affiliate link for the best product, it's still included in the same way. More info: See How This Site is Financed. As we believe transparency is important, we're including the following 'un-affiliated' web-addresses for content too: Unaffiliated web-addresses for links in this email coventrybuildingsociety.co.uk, birminghammidshires.co.uk, wyelandsbank.co.uk, starlingbank.com, monzo.com, natwest.com, bank.marksandspencer.com, moneysupermarket.com, comparethemarket.com, gocompare.com, confused.com, co-opinsurance.co.uk, directline.com, churchill.com, aviva.co.uk, vodafone.co.uk, mbna.co.uk, santander.co.uk, sainsburysbank.co.uk Financial Conduct Authority (FCA) Note MoneySupermarket.com Financial Group Limited is authorised and regulated by the Financial Conduct Authority (FRN: 303190). MoneySavingExpert.com Ltd is a company registered in England and Wales. Company Registration Number: 8021764. Registered office: One Dean Street, London, W1D 3RB. MoneySavingExpert.com Limited is an appointed representative of MoneySupermarket.com Financial Group Limited. To change your email or stop receiving the weekly tips (unsubscribe): Go to: www.moneysavingexpert.com/tips. |

No comments:

Post a Comment