Martin's Masterclass: How to max savings interest

Don't settle for less than 4% interest! And for some, there are even ways to push & get 7%, 25% or even 50%!

Includes full savings & cash ISA best buys...

UK interest rates are likely on the move. And that means savers need to check what they earn now. Millions are on pants sub-4% rates and can easily ditch, switch & gain. All you usually need to do (barring with ISAs) is withdraw your money from one account and put it in a new one.

UK interest rates are likely on the move. And that means savers need to check what they earn now. Millions are on pants sub-4% rates and can easily ditch, switch & gain. All you usually need to do (barring with ISAs) is withdraw your money from one account and put it in a new one.

Most analysts believe next Thursday the Bank of England will likely cut the UK base rate again, from the current 4.25% to 4%. Good news for some with debt, but a sign savers need to take action. So I'll take you through:

- 5% easy-access (variable) savings: Take money out when you want.

- 4.5% fixed savings: Lock in a guaranteed interest rate.

- 3 ways to boost interest up to 50%: For those who put money aside each month OR 1st time buyers OR those on Universal Credit.

- 3 ways to minimise tax on interest: Including cash ISAs & Premium Bonds.

Prefer to listen than read? You can hear me talk through this in my new 'Beginner's guide to savings' podcast. First though...

| Before saving... 3 important questions |

- Do you have expensive debts? If so, use spare cash to clear them first. A grand's debt over a year on a credit card at a typical 25% costs £250 in interest, while the same saved at 5% earns £50. Pay off the debt with the savings and you're £200/yr better off. For far more on the best way to do this, see Should I pay debt with savings?

- Is your mortgage rate higher than you can earn in savings? If so, as long as you've a cash emergency fund, do check our Mortgage Overpayment Calc to see whether it's worth you overpaying rather than saving (most can overpay 10% of mortgage debt a year penalty-free, but do check). For more, including how to ensure you get the full benefit of overpaying, see our Should I overpay my mortgage? guide.

- Putting away money for 5+ years? Have you considered investing too? In a wide spread of assets over 5+ years, on the balance of probability, investing will likely substantially outperform saving, so many should have some of their assets invested. For help on where to start listen to my 'Beginner's guide to investing' podcast and read our Investment ISA guide.

|

All accounts listed below are quoted as AER interest, and all have full UK £85,000 savings safety protection.

It's important to ask yourself, 'Do I want an easy life with decent rates, or am I prepared to put in more work to maximise the interest on every penny?' There's no right answer, but be honest with yourself. Don't set out to become a SuperSaver if you won't keep it up - as in that case, it's better to play safe and stick with one or both of these simple, less effort routes...

1. The top bog-standard EASY-ACCESS savings pay 5% (variable)

Easy-access is the simplest form of savings. So if you do nothing else, put all money you don't imminently need in a top-paying one of these, rather than leaving it lingering at a low rate in a poor savings account, or worse, a zero interest current account.

- Pros: You can put money in and take it out when you want, giving total flexibility. Plus, you can easily switch provider to up interest.

- Cons: Rates are variable, so they move, often with Bank of England base rates (usually a few weeks later). But also, firms often drop them after a while hoping you won't notice. So, monitor the rate (at least every few months) and be prepared to ditch & switch if needed.

Below are the current best buys, though they do change - for updates use our trial at-a-glance Savings Hub, or see top easy-access savings.

- Top normal easy-access savings rates. Your winner will depend on what accounts you already have and how often you need to access the money.

- Top but newbies only: Chase (part of JPMorgan) 5%* (min £1, max £3m) but that includes a 1yr 2.25% bonus for new Chase customers (otherwise it's not worth it). You get it via its app-only current account, but you don't need to switch to do that, and it doesn't do a hard credit-check so almost anyone can get it.

- Top open-to-all: App-based Atom Bank's 4.6%* (min £1, max £100,000). As the interest drops to 2.5% in any month you withdraw, it's best for those who don't want to withdraw too often.

- Top 'name you know': Cahoot (part of Santander) 4.55% (min £1, max £500,000), yet it only lasts a year then 'matures' to a lower rate deal. So be ready to ditch it then.

- Top straight rates: These are open to all, with no time limits or reduced interest on withdrawals - Kent Reliance 4.41% (min £1, max £500,000) and Hodge Bank 4.4% (min £1, max £250,000).

- Santander Edge customer? You can get its Edge Saver at 6% but only on up to £4,000.

- Top easy-access cash ISAs may beat them. A cash ISA is just a savings account you can put up to £20,000 per tax year in, where the interest is NEVER taxed (more on that later). And right now, the top payers beat all but Chase above. So, even if you don't need the tax advantage, if you haven't used your £20,000 ISA allowance this year, they can be winners.

- Top but newbies only: Trading 212's 4.87%* (min £1) allows unlimited withdrawals. The rate includes a 1yr 0.77% bonus for new Trading 212 customers. Plum's 4.86% (min £100) pays the same, and includes a 1yr 1.57% newbie bonus, but here, withdraw more than three times a year and it drops to just 3.29%.

- Top straight rate: Tembo's 4.64% (min £10), which allows unlimited withdrawals.

2. Top FIXED RATE savings pay 4.5%, but here the rate is guaranteed - it won't change

For those who want to put some money away with certainty of exactly what you'll be paid, without needing to monitor it - this is for you. As you have to lock it away to do it, most people will want some money in easy-access and some in fixed to get the best of both worlds. With fixes...

- Pros: Certainty. Base rate drops won't affect you. Crucially, this means while easy-access rates are currently higher, if the UK base rate drops as predicted, if you fix now, in a few months the rate you're locked in to may look good compared with easy-access.

- Cons: Your money's locked away without access (except in fixed ISAs), so only put money in that you definitely won't need to touch within that time. Plus, if rates rise elsewhere, you are stuck with this until the fix ends.

| Top fixed savings (AERs) |

Normal savings

Your savings are locked away without access during the fix. | Cash ISAs

You can withdraw by closing it early, but must pay a 60 to 365-day interest penalty. A decent option if you may need access during the fix. |

| 1-year fixes |

Conister 4.53% (min £5,000)

GB Bank 4.5% (min £1,000)

Bigger name

NS&I 4.18% (min £500) | |

| 2-year fixes |

DF Capital 4.44% (min £1,000)

GB Bank 4.41% (min £1,000)

Bigger name

Cahoot (Santander) 4.1% (min £500) | Cynergy 4.2% (min £500)

United Trust 4.19% (min £5,000)

Bigger name

Yorkshire BS 4.1% (min £100) |

| 3-year fixes |

Birmingham Bank 4.44% (min £5,000)

DF Capital 4.43% (min £1,000)

Bigger name

Yorkshire BS 4% (min £1,000) | United Trust 4.21% (min £5,000)

Cynergy 4.2% (min £500)

Bigger name

Yorkshire BS 4.1% (min £100) |

| 5-year fixes |

Birmingham Bank 4.51% (min £5,000)

Chetwood 4.5% (min £1,000)

Bigger name

Leeds BS 3.9% (min £100) | Castle Trust 4.24% (min £1,000)

Nottingham BS 4.23% (min £500)

Bigger name

Leeds BS 3.9% (min £100) |

How long should you fix for? Provided you are comfortable locking the money away, the more you value certainty, the longer you should fix for. Though there are no guarantees that with hindsight that'll be the best option.

Also, it's worth remembering while fixed rates are... well... fixed, if UK interest rates look like they'll fall further than currently thought, the rate you'll be able to fix at in future will drop. So there is a time element to the decision.

| Bigger saver? Get £100 cashback and less admin... |

| If you've a lot of savings, and a number of different accounts, the admin of opening a new account and switching each time can mean you don't bother - and lose interest because of it. In the last few years, a new range of platforms such as Raisin's*, Flagstone's and Hargreaves Lansdown's are trying to make that easier. When you join one, you put your money in them, and then can open multiple accounts at different banks with no admin, just a click. Same too when you want to switch savings - you can do it with a click. Importantly, your money is still held by the underlying bank, not the platform, so it has the bank's £85,000 savings protection. The rates tend to be marginally less than the very best buys we list, though sometimes they do have exclusives that beat them: - Open Raisin with £10,000 and you get £100 added. Newbies who register via this Raisin* link with code SAVINGS100 by 18 August, then open a savings account and put in £10,000+ by 31 August, get £100 automatically added (28 days after opening a fix of 6mths+, or after you've had money in easy-access for 6mths).

Its top easy-access account is currently 4.25%, and 1yr fix 4.38%, but the £100 acts as an extra 1 percentage point on £10,000, so with that, it's a winner. |

Don't think you can only have one savings account - you can have as many as you want, all with different providers if you choose. The basic building blocks are the easy-access and fixed accounts above.

Yet there are some savings products paying more, that either: a) limit who can get them; or b) limit the amount you can put in. If they apply to you, though, they're worth having.

Yet there are some savings products paying more, that either: a) limit who can get them; or b) limit the amount you can put in. If they apply to you, though, they're worth having.

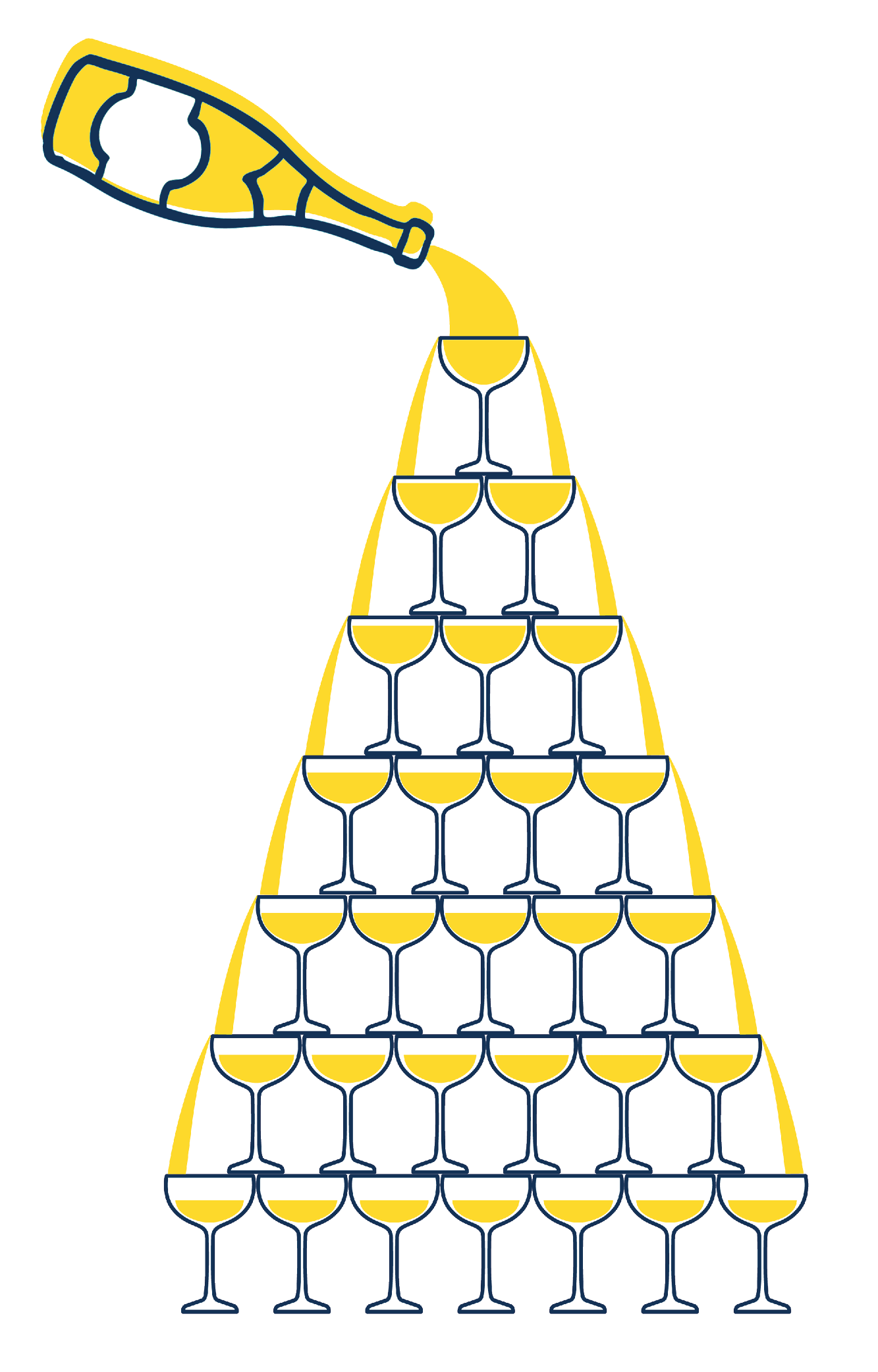

For those on the 'trying to maximise every penny' strategy (the best), think of this like a savings 'champagne' fountain. You pour your cash into the best possible product, then when it's full, move to the next one down and so on. So let's run through this in order of maximum returns...

1. Help to Save: An unbeatable 50% boost on what you save, if you work and are on Universal Credit

If you're on Universal Credit (UC), and earn anything from working, you can open a Help to Save account on the Gov.uk website. Once it's open you can continue to use it even if you become no longer eligible for UC.

With Help to Save you can put up to £50/mth in and, after two years, you get a 50% bonus on the max you had in - even if you've withdrawn the money. There's nowt else close to it. My wee graphic explains...

After you get the first two-year bonus, you can do it again for two more years and get another 50% bonus. See full how Help to Save works.

As Claire emailed me about Help to Save: "Have saved for the last 4 years... am about to cash out my last £2,400 plus my second £600 bonus... so £3,600 in total. It's been tight some months, but I have always pulled the cash together to get the max back. Thanks for the tip all of those years ago!"

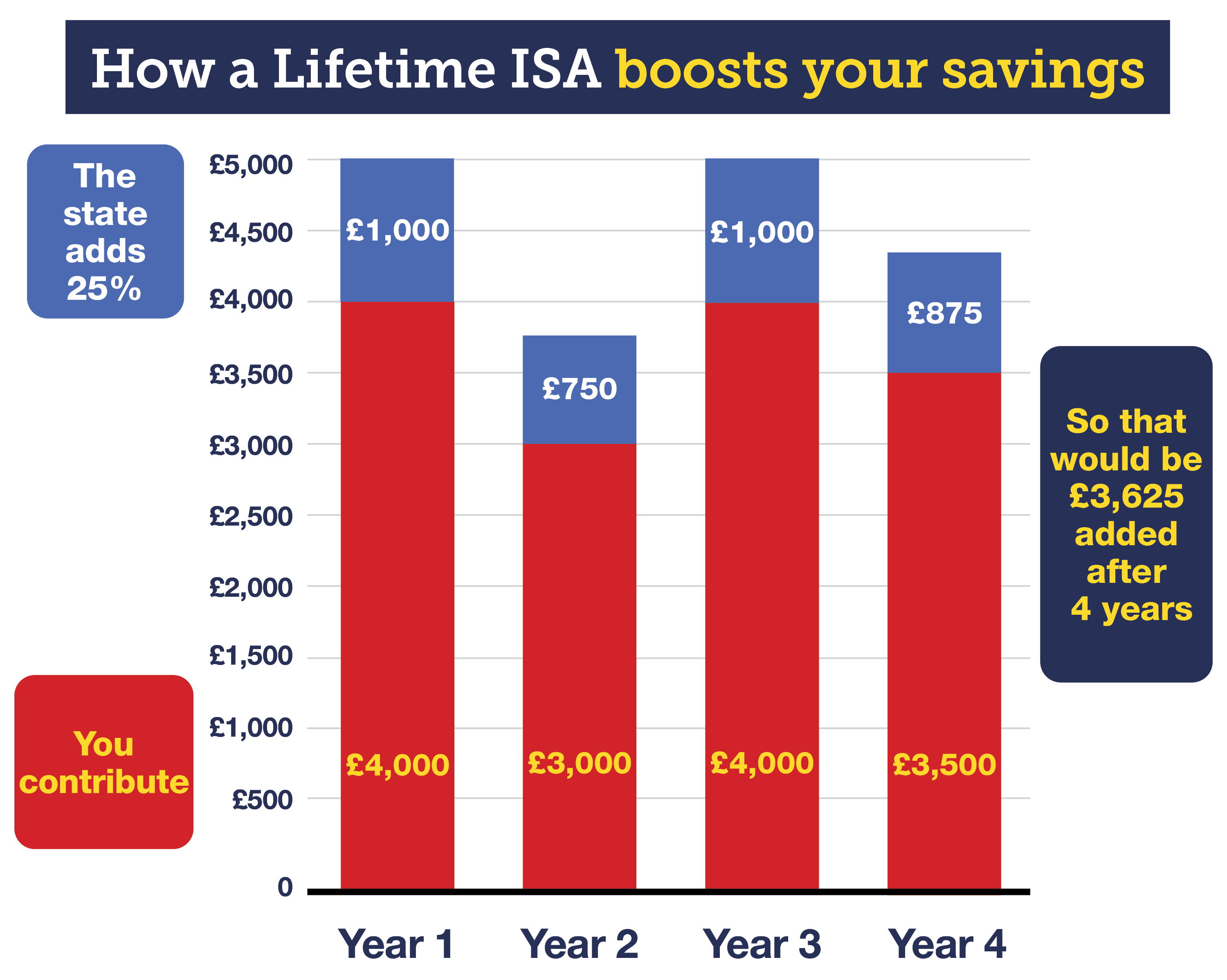

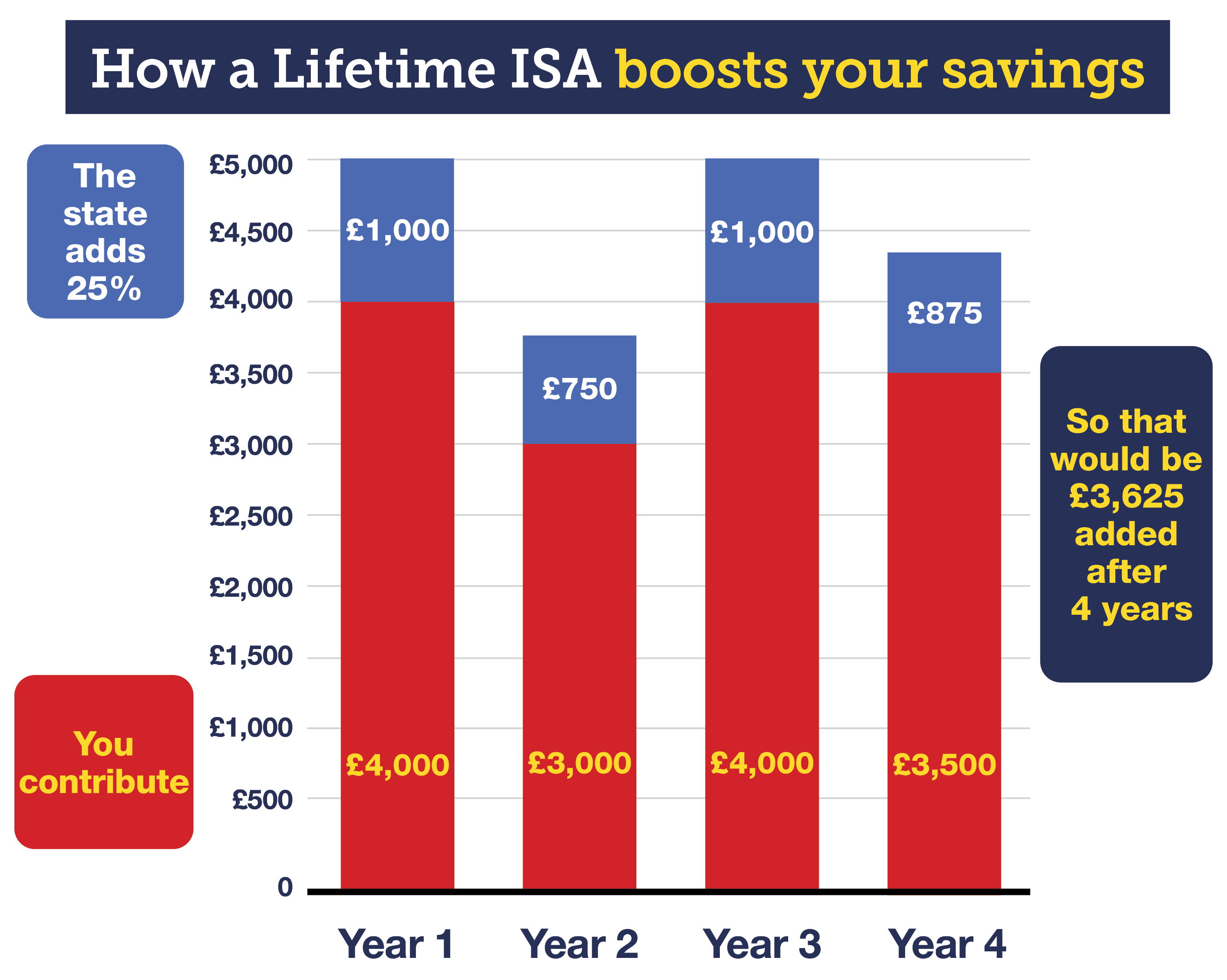

2. Lifetime ISA (LISA): A huge 25% boost for first-time buyers aged 18 to 39

A Lifetime ISA is a tax-free savings or investment account that anyone aged 18 to 39 can open (once it's open, you can keep it going even after you're 40). Its primary use is to help first-time buyers build a deposit, though it can also be used to save towards older age. Full help in our Top Lifetime ISAs guide, but in brief...

- You can put in up to £4,000 each tax year until you're 50 and get a 25% bonus added to it. So, put the max £4,000 in and you get £1,000 added.

- This can then be used as a deposit on your first residential mortgage, as long as the property costs under £450,000.

- It's an individual product, so two first-time buyers buying together can have one each, while a first-timer can still use it even if buying with someone who's owned before.

Yet there's one big warning. There are only three ways to keep the bonus and take money out penalty-free: i) when getting a mortgage on a first home under £450,000 done via your conveyancing solicitor; ii) once you're aged 60+; iii) if you die or have less than 12mths to live.

If not, withdraw and you effectively get back 6.25% LESS than you put in (see how LISA penalties work). So LISAs are only good for first-timers who know they'll buy a home under £450,000.

If that's you, though, it can be great, as Jordan emailed a year or so back: "Hi there, love the newsletter (and Martin Lewis podcast). Another Lifetime ISA success for you - I saved 7 years and my partner 6 so we got £13k towards our deposit from the Government. With interest that got us to a 20% deposit on a £330k property we completed on a couple of months ago. Thanks."

The top savings LISAs today are Moneybox 4.7% & Plum 4.6%. Both are app-only and include 12mth newbies-only bonuses. Tembo at 4.33% doesn't include a bonus rate, it's app only and can be opened with £1+. More options & help in Top LISAs.

3. Regular savings accounts. Earn 7% interest on smaller amounts (plus a possible free £175)

As the name suggests, the top regular savings accounts give high interest on money put aside each month. You can have multiple regular savers in different places, so you could save a combined £1,000+/mth in them.

The best rates are with accounts linked to current accounts (ie, you usually must have a provider's current account to open it). These are likely loss-leaders to win or keep your banking custom - affordable for the banks, as the amounts are small.

If you've got lump-sum savings and want these rates, just arrange to move the max amount from those savings into these each month.

| Top-paying regular savers |

| Bank-linked regular savers (& any bank-switching bonuses) |

| Zopa Biscuit | 7.1% variable on up to £300/mth (max £137 interest) |

| First Direct 1st Account* (FREE £175) | 7% fixed for 1yr on £25 to £300/mth (max £135 interest) |

| Co-op | 7% variable for 1yr on up to £250/mth (max £113 interest) |

| Club Lloyds | 6.25% fixed for 1yr on up to £400/mth (max £161 interest) |

| NatWest / RBS (FREE £175) | 5.5% variable on up to £150/mth (max £53 year 1 interest, but as it doesn't then stop, this keeps growing in years after) |

| TSB* (FREE £190 over 6mths) | 5% fixed for 1yr on up to £250/mth (max £81 interest) |

| Current-account customers of Skipton BS, Bank of Scotland, Halifax, Nationwide, Lloyds, Yorkshire BS, HSBC and Santander can also get regular savers paying at least 5%. |

| Top regular savers that are open to all... |

| Principality BS | 7.5% fixed for 6mths on up to £200/mth (max £26 interest) |

| Monmouthshire BS | 6% variable for 1yr on up to £500/mth (max £193 interest) |

| Skipton BS | 5.75% variable for 1yr on up to £200/mth (max £74 interest) |

| Progressive BS and Newcastle BS also offer 5%+ regular savers. |

Why regular payers' interest often feels less than it is. At the end of the year, many feel they're being conned when they see the interest. The reason some have this problem is...

- Imagine you're saving £300/mth at 7% interest.

- After a year, you've £3,600 in there.

- So you think 7% of £3,600 is c. £250 and that's what you should get.

Then you look and see you've far less. This is because you've not had £3,600 in for a year; you've been dripping it in each month. In fact, your average balance over the year is roughly half that, £1,800, so the interest will be closer to 7% of that.

Yet don't let that put you off. On the money in them there's no higher interest. And if you're putting it in from lump-sum savings, remember you're earning interest there while you wait for the money to go in.

There's a lot of confusion about tax on savings - so it's worth starting with my new 'You don't pay tax on savings' 1m video easy-explainer. Then read on...

1. There are more tax-free savings allowances than most people know

Savings aren't taxed - it's the interest on them that is. Yet even then, most needn't pay it, as there are substantial tax-free allowances:

- Your Personal Allowance: Most can earn up to £12,570 tax-free. This is how much you can earn (from anything, eg, work, pension, interest) before paying Income Tax. If your total earnings are less than that, then all your interest is therefore tax-free.

- Starting Savings Rate: If you've low work earnings but bigger savings interest. The Starting Rate for Savings means some can earn up to £18,570 of earnings and interest combined without paying any tax on it (the link explains how).

- Personal Savings Allowance: Up to £1,000 tax-free interest. Your Personal Savings Allowance (PSA) is on top of the allowance above - it's the amount of interest you can earn from ANY & ALL SAVINGS without paying tax on it.

- Basic 20% rate taxpayers can earn £1,000 interest a tax year.

- Higher 40% rate taxpayers can earn £500 interest a tax year.

- Top 45% rate taxpayers do not get a PSA.

To put this in context, the top easy-access rate is currently 5%. You'd need £20,000 in it to generate £1,000 interest, so only basic-rate taxpayers with more than that would pay tax (for higher-rate taxpayers it's over £10,000). This, combined with cash ISAs below, means all but the biggest savers won't pay any tax on interest at all.

How you pay tax on savings, if you need to. If you're sent a self-assessment tax form (ie, tax return) to do each year, you do it via that. If not, and your interest is under £10,000/yr, you don't need to do anything - the tax office (HMRC) will simply change your tax code. If you get more than £10,000 interest, you'll need to do a tax return.

2. You can save £20,000 tax-free each year in a cash ISA - this is on top of other allowances

Cash ISAs are just savings accounts where the interest is NEVER taxed, and crucially the interest doesn't count towards your Starting Savings Rate or Personal Savings Allowance, so this is extra on top of those. See my 'Understanding ISAs is a piece of cake' video, as a primer.

It's a crucial extra allowance, which anyone who earns or saves enough to pay tax on savings interest (or thinks they may do in future) should take advantage of. Plus, right now, top cash ISA rates are either better, or only a little less, than top normal savings, so there's no real rate sacrifice involved.

To show you how important this is, imagine £20,000 that would otherwise be taxed, over a year:

- In the top easy-access cash ISA, you'd earn 4.87%, so £974 interest.

- In top normal savings, you could get 5% interest, so that's £1,000 interest with no tax, but just £800 with 20% tax, £600 with 40% tax or £550 at 45% tax. In other words, in those cases, the top cash ISAs smack the pants off normal savings.

And, crucially, once you've put money in a cash ISA, it stays tax-free year after year. So, you could have put £20,000 in last year, £20,000 in this tax year, and (unless the limit changes) £20,000 in next tax year. It can end up being a huge sum. All the best buys are in the easy-access and top fixes sections above.

Don't let your money fester on poor cash ISA rates

Too many think they put their money in a cash ISA and it's stuck there. It's not - you've a right to transfer it to a new top payer. Yet don't just withdraw the cash - you'll lose its ISA status. Instead, apply for a new cash ISA, and as part of the application, you'll be asked whether you want them to transfer your existing cash ISA over...

- You don't need to be adding any money to do this.

- It doesn't use up your £20,000 allowance - that's only for new money.

- Got an old fixed-rate cash ISA? See whether it's worth paying the penalty to move it via our 'Should I ditch my fixed ISA?' calc.

- All the top fixed rate and top easy-access cash ISAs allow transfers, though with the easy-access ones you usually don't get the newbie rates.

3. You can put £50,000 tax-free in Premium Bonds but the prize fund rate is about to drop to 3.6%

I'm not the biggest fan of Premium Bonds for most people. The vast majority of those with typical luck will do better just putting money in top savings. Premium Bonds' tax-free nature, though, does mean they come into their own for people who pay tax on savings and have used up their ISA allowance.

In that case, provided you're putting a larger amount in (as you need to do that to have a decent chance of winning closer to the published prize rate), they can be a good option. For a full explanation, see our Are Premium Bonds worth it? guide.

Yet there are some savings products paying more, that either: a) limit who can get them; or b) limit the amount you can put in. If they apply to you, though, they're worth having.

Yet there are some savings products paying more, that either: a) limit who can get them; or b) limit the amount you can put in. If they apply to you, though, they're worth having.